The Q3 earnings report of Sea Ltd., the parent company of Shopee, caused an uproar last month as its share price dropped by 16.7%. Shopee has made a big pivot to top-line growth this year, meaning that it is sacrificing profitability to secure market share. We have discussed the implications of this in our previous report. Now to dig a bit further, we examine another key metric that correlates with Shopee’s profitability – the Average Order Value (AOV). Read on to learn more.

Context: AOV serves as a crucial metric of consumer spending within each transaction or basket, especially for multi-category e-commerce like Shopee.

It is calculated as the total sales figure for a given period divided by the number of orders in the same period.

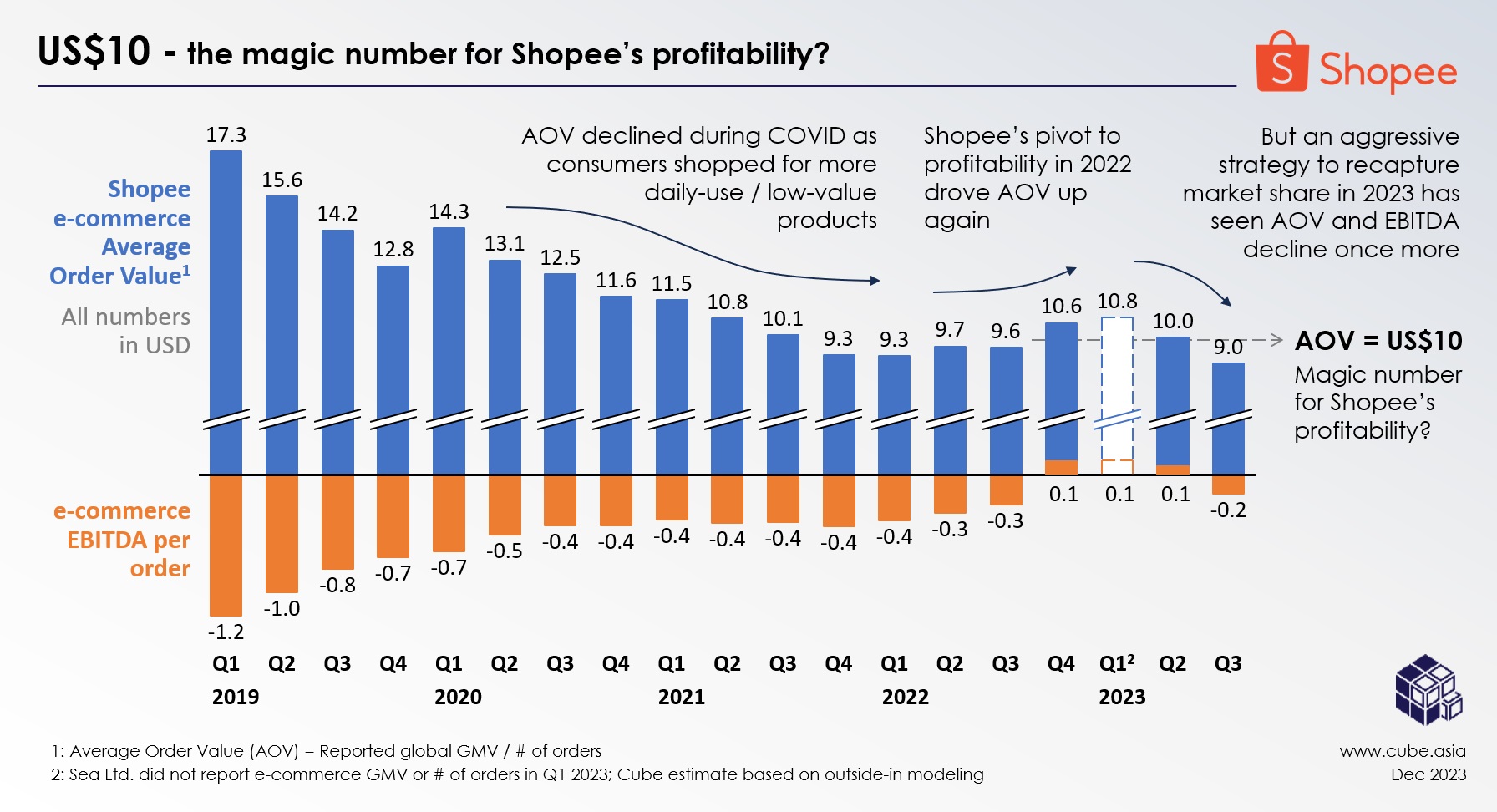

The above exhibit charts Shopee’s AOV and EBITDA profitability per order by quarter going back to 2019. One immediate takeaway is that Shopee’s AOV has been declining steadily over time. This trend briefly paused in the early days of the COVID pandemic in Q1 2020, as changes in e-commerce activity led to more bulk purchases. However, the AOV quickly returned to its declining pattern after this unique moment. Another significant period occurred between Q4 2022 and Q2 2023 when the company made several moves to optimize profitability and reached EBITDA profitability in three consecutive quarters with AOVs of more than $10, but both AOV and EBITDA have come back down since then.

This trend raises two interesting questions:

1. Why does the $10 mark seem to be the profitability threshold for Shopee?

The biggest factor here is the cost of shipping and the role of platform subsidies.

An average order costs $1-2 to deliver in Indonesia. For AOVs below $10, that can be 10-20% of the GMV, a cost comparable to the entire top-line commission that Shopee is making from these orders.

Shopee’s subsidies on shipping fees can play havoc with these economics, by encouraging consumers to place more frequent and smaller orders. As they now have less incentive to batch orders, the result will be a lower AOV. And with shipping fees being more closely tied to the number of orders, rather than GMV, it means that Shopee’s shipping subsidies also impact unit profitability. Although last-mile charges are dropping in Southeast Asia, they are only doing so at 2-3% per year, which is not quick enough to support profitability with a single-digit AOV anytime soon.

2. Shopee must have seen these numbers in their internal review meetings. Why have they allowed AOV to drop again?

This question is a bit more complicated than the first one, and it is impossible to answer it with a single factor. Rather, as we map the internal and external considerations, several factors become relevant to study. Here are the most important ones:

2a. Supply side factor: Shifts in platform category mix

In its quest to find new growth segments, Shopee has had to shift towards lower-priced categories over time. As per Cube’s estimates, F&B sales contribute to less than 5% of Shopee’s Indonesia GMV, compared to 20-25% of overall consumer spending in the country according to DBS, which points to a clear opportunity space. Furthermore, given Tokopedia’s traditional dominance in electronics, and fierce competition from TikTok Shop in beauty & fashion, it would seem natural for Shopee to want to find a growth area that has less competitive intensity, even if AOVs in F&B are smaller. Livestream vouchers, for example, provide better deals to certain categories to incentivize growth.

2b. Supply side factor: Price erosion from seller competition

The last few years have seen a proliferation of homegrown D2C brands in popular categories such as beauty and fashion. These brands have been early adopters of new e-commerce innovations (as we had covered earlier this year), and are often operating with a lower cost base versus incumbents. This has led to increased pricing competition, resulting in a lower average product price on the platform. Although Shopee has been able to drive higher sales volume, the lower average prices have also led to lower AOVs.

2c. Demand side factor: Changes in consumer purchase habits

Changes in consumer purchase habits have been heavily influenced by broader economic factors over the last year, such as geopolitical crises and a rise in interest rates. These challenges have impacted consumer confidence level, leading consumers to choose less expensive items, or “trading down.” For example, consumers may transition from purchasing pricier branded canned tuna to choosing more budget-friendly alternatives, further pulling down the AOVs.

Implication for stakeholders

Investors – Alongside monitoring EBITDA and GMV, keeping track of AOV will be useful for gauging how Shopee is balancing top-line growth with profitability. In this case, the decline in AOV offers investors with insights into both internal and external factors. Internally, it reflects Shopee’s strategic adjustments for heightened competitiveness, whether through increased subsidies or a shift in category focus. Externally, it indicates shifts in consumer behavior over time, including a preference for emerging lower-priced categories or a trend toward “trading down.”

Brands – While Shopee will continue to subsidize growth, this support is expected to diminish over time. Brands relying on subsidized shipping on low-value orders should be mindful that such subsidies might die out, particularly if low-value orders constitute an ever increasing portion of e-commerce sales going forward. As Shopee pushes the cost of shipping more on to the sellers, finding ways to increase AOV, such as introducing larger offerings like bundling, will contribute to a healthier operating margin ratio.

We are committed to delivering insightful e-commerce reports. For those interested in our updates, please stay tuned for our latest releases by subscribing to our newsletter or reaching out to us via email at info@cube.asia.