Over the past few years, consumer preferences have evolved in a way that has created a new market for products and services that more closely align with the values held by younger consumers. This evolution has led to the rise and success of many emerging brands, especially in the Western market. For instance, Olipop is disrupting the soda market with their prebiotic-infused beverages, catering to a growing pool of health-conscious consumers. Founded in 2018, their sales are already projected to reach $500 million in 2024. Organic-certified grocer, Whole Foods, was acquired by Amazon in 2017 for US$13.7B and currently has more than 500 stores in the United States. The Honest Company, one of the early movers addressing the demand for clean products in the home and personal care category, made over US$300M in sales in 2023.

A global study reveals that roughly 65% of global consumers are aiming to bolster their health and well-being by refining their dietary habits over the next 12 months. Approximately 64% express concerns regarding environmental issues. This shift towards making healthier and more sustainable choices is particularly notable among Millennials and Gen Zs, with around 30% already having taken steps, such as researching a company’s environmental impact before purchasing products or adopting a vegetarian or vegan diet, for example. This group of younger consumers are seeking products or services with “Better For You” attributes.

As a result, we have started to see numerous brands in the Western market with “Better For You” attributes, particularly in the F&B, beauty, personal care, homecare categories, achieve success. But has this shift also reached Southeast Asia? We surveyed Gen Z and Millennial consumers in Indonesia, Vietnam and Singapore, and our results show that there is indeed a growing demand for “Better For You” products and services in Southeast Asia.

So what exactly is “Better For You”?

The term “Better For You” is nuanced and can hold different meanings depending on the product category and the individual consumer; however, it can be broadly summarized into the following 3 categories:

- Better for You: Typically linked to health and wellness, this includes products that are organic, natural, chemical-free, vegan, or personalized to the individual’s needs.

Example: Olipop is a beverage brand offering natural, low-sugar sodas with prebiotics and botanical extracts for digestive health.

- Better for Society: Driven by the desire to positively impact the community, these include products and services that exhibit traits like fair labor practices, inclusive employment and/or locally-sourced ingredients.

Example: Whole Foods Market is a grocery chain that supports local farmers and producers, emphasizing fair trade and community engagement.

- Better for the Planet: This includes products and services that have a positive impact on the environment, exhibiting attributes such as being recyclable, being produced or made from recycled material and/or being cruelty-free.

Example: Patagonia is an outdoor apparel company recognized for its sustainable practices, including the use of recycled materials and environmental initiatives.

92% of Gen Z and Millennial Southeast Asian consumers make “Better For You” purchasing decisions

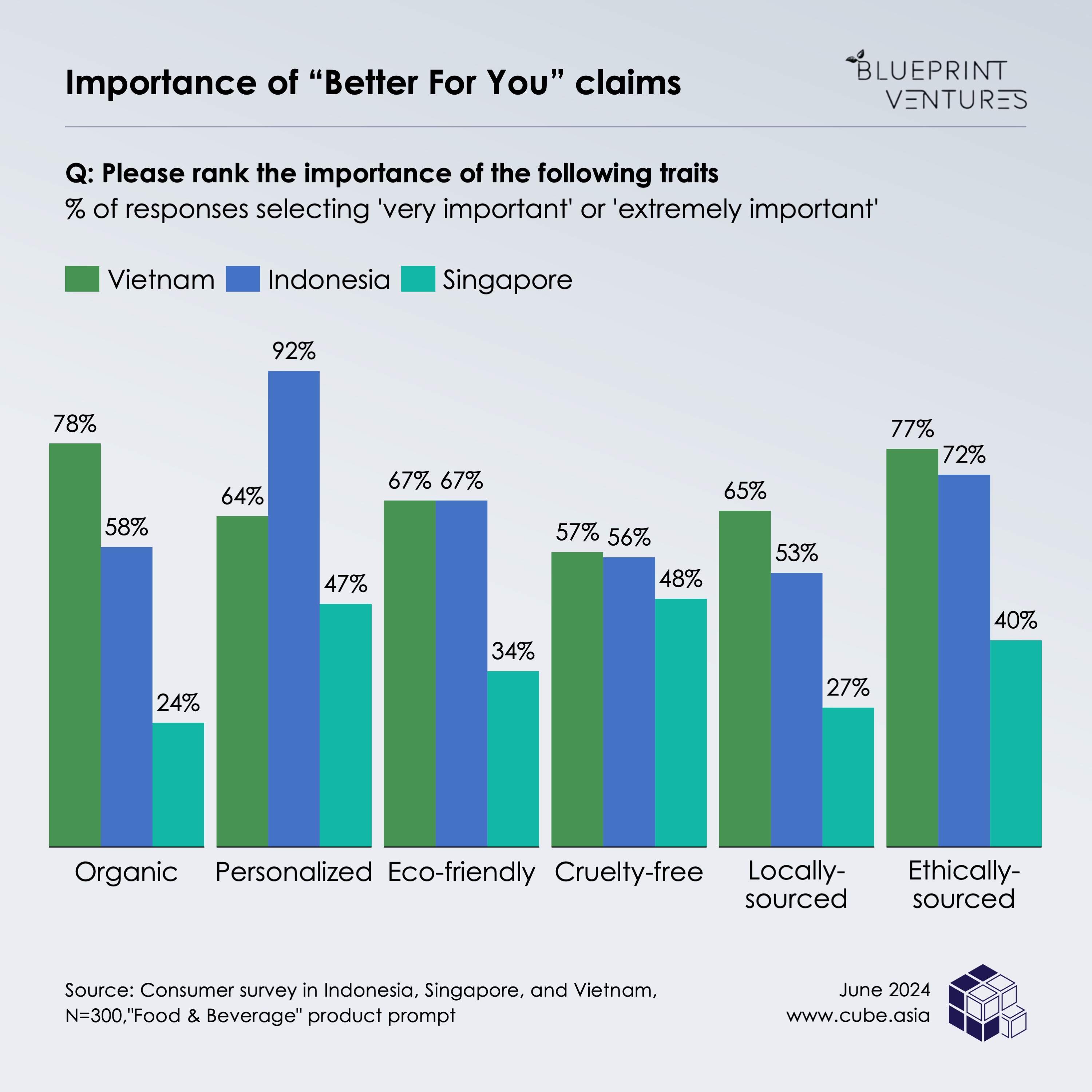

To assess the perceived importance of various “Better For You” factors among consumers, we surveyed 300 urban Gen Z and Millennial consumers in Indonesia, Vietnam, and Singapore about their purchasing preferences.

Our findings show that 92% of these consumers rated at least one “Better For You” factor as very or extremely important. However, preferences do vary by market:

Vietnam: High importance is placed on organic and ethically-sourced products among Vietnamese consumers. 88% of respondents indicated that it is important to understand how products are made. This highlights a strong desire for transparency and ethical considerations when making purchasing decisions.

Indonesia: Consumers strongly prioritize personalized and ethically-sourced products. When asked why it is important for them to know how products are made, they revealed hygiene, safety, and sustainability as their key factors.

Singapore: There is a preference for products that are personalized and cruelty-free, suggesting a preference towards products that cater to their individual needs and are free from animal testing.

Consumer willingness to pay a premium varies across Southeast Asian countries, with stronger willingness to pay in Indonesia and Vietnam

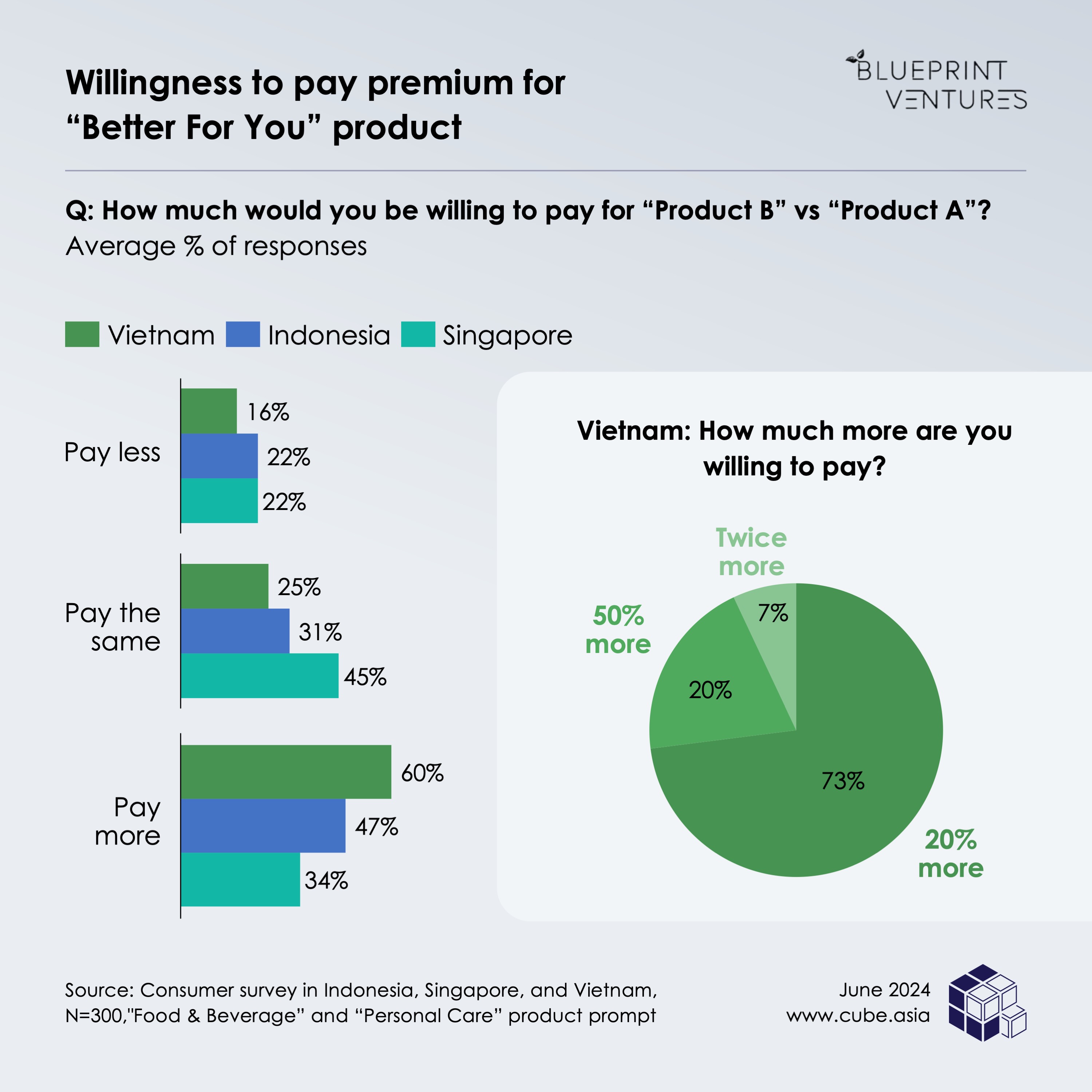

While “Better For You” does not inherently mean premium-priced, many products from the earlier wave of “Better For You” in Western markets were priced higher than their alternatives. This price difference often stemmed from the use of more expensive ingredients, sustainable production methods, and ethical sourcing practices. As a result, consumers who prioritized these factors were oftentimes faced with higher prices, which can be a barrier for Southeast Asia’s price-sensitive consumers.

As such, we wanted to understand if there was a market for “Better For You” products in Southeast Asia given the region’s overall price sensitivity.

We asked consumers how much more they would be willing to pay for ‘Product B,’ a product with ‘Better For You’ attributes, compared to ‘Product A,’ a product without. As illustrated above, across the three countries, 34-60% of the surveyed consumers indicated a willingness to pay a premium for “Better For You” products, with many in Vietnam willing to pay up to 20% more.

Willingness to pay more for such products appears to be correlated to the degree of importance the consumers place on “Better For You” attributes. Based on our survey, we saw that Indonesian and Vietnamese consumers are especially willing to pay a premium for “Better For You” products and we are bullish about the potential for future growth in this product segment in these two markets.

Interestingly, despite Singapore having the highest disposable income compared to the other markets, there is a lower willingness to pay a premium for “Better For You” products, indicating a preference for products or brands they are more familiar with.

Expect “Better For You” expansion into more categories in the future

The “Better For You” movement is notably gaining importance among consumers in Southeast Asia, especially in the fast-moving consumer goods (FMCG) sector, such as F&B and personal care. A wider set of categories, however, is expected as respondents have also indicated other categories where “Better For You” attributes are becoming increasingly important to them. This includes categories such as:

Fashion & Apparel, where consumers cited environmental impact and the desire for more personalization in this category. For example, customizable or tailored clothing that caters to their lifestyle, interest, and preference.

Homecare, where respondents indicated environmental impact and health-related factors as important considerations when making homecare-related purchases. This may involve preferences for eco-friendly cleaning products or products free from harsh chemicals.

We expect these categories to form the second wave of “Better For You” products and services in the coming years. This evolving market presents a unique opportunity for brands to capitalize on the increasing consumer demand for “Better For You” attributes, extending beyond existing categories into new and untapped areas. The shift towards “Better For You” products signifies a lasting and transformative change in consumer behavior, driving a focus on values that defy traditionally price-sensitive behavior.

Note: This is an independent report, and has not been sponsored by any of the brands featured in this analysis.

Blueprint Ventures is an early-stage consumer-first venture capital firm. The VC invest across Southeast Asia into consumer and consumer-tech businesses for the new Southeast Asian consumer – Millennials, Gen Zs and Gen Alphas. They make insights-led investments anchored on themes and trends that matter most to them.