This blog was originally published on chalawan.asia, as part of the SE Asia Social Commerce research research. The initiative will continue under the cube.asia banner, and future posts on this topic syndicated on both sites. You can learn more about the initiative here.

Our mission is to bring clarity, tools, and resources to social commerce in Southeast Asia; all built for brands and retailers. We will define social commerce on the basis of six archetypes, all of which exist within the broader universe of e-commerce.

The discussion below may feel a bit theoretical. But in the spirit of being rigorous, we feel it is important to put down a solid conceptual foundation before analyzing or trying to size this growing market.

First thing first: Social commerce is a subset of e-commerce

E-commerce is generally defined as digital transactions of physical goods between two parties, and we believe that’s a good outer boundary for defining and sizing what social commerce is and isn’t too.

What makes it different from other forms of e-commerce is, of course, that it’s “social”.

Many others have tried to articulate what “social” means. Accenture for example, defines it as a form of “commerce … underpinned by the authenticity and trust that social connections provide” and “engages in three principal ways: unique content, experiences, or social networks.”

According to Bain, what makes e-commerce social is that “in addition to building trust [it] meets growing consumer demand for i) greater product variety and customization, ii) a feeling of community connection and trust, iii) convenience, iv) bargaining experience similar to offline purchases, and v) a fun and engaging shopping experience.”

These definitions are intuitive enough, albeit a bit vague. To get to the real insights though, we need to go deeper, and answer questions like why is this subset of e-commerce growing so fast, what are its different archetypes, and what does it all mean for stakeholders in the space.

Social commerce develops at the intersection between e-commerce platforms and social platforms

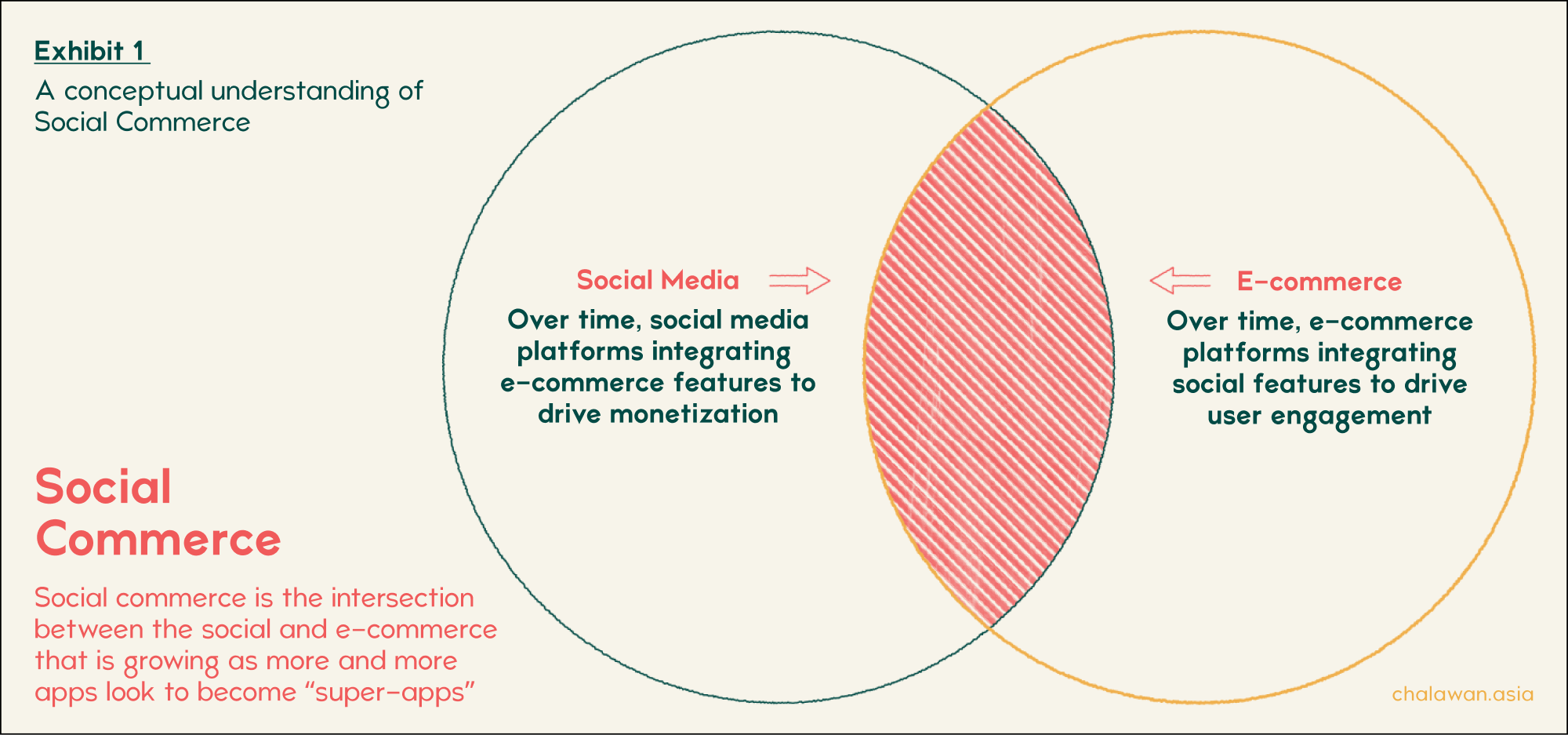

We’ve looked at the social commerce landscape through a number of lenses such as seller type, by customer journey, and by platform. While social commerce shows up in a number of very different and distinct ways, what they all have in common is that they exist and develop between what’s traditionally been described as e-commerce platforms and social platforms, as conceptually drawn in Exhibit 1.

We think this captures the dynamic aspect of social commerce – for while it wasn’t really part of the common lingo in the early days of social media and e-commerce platforms, the rise of “super-apps” has brought these ecosystems together. And now everyone seems to be talking about social commerce.

Platforms and consumers are both enabling this dynamic:

- Social platforms like Facebook, Instagram and TikTok are building commerce features to remove friction of outbound advertising and keep users inside their platform through the whole purchase journey.

- E-commerce platforms like Shopee, Zalora and individual brand dotcom’s are building social features like chat-and-shop, live streaming and customer reviews to improve shopper engagement and provide better service.

- Consumers are seeking more entertaining, trustworthy, easy and delightful ways of shopping online, sometimes enabled by existing platforms and other times enabled by brand-new ways of shopping, like community group buying.

The result is that “social” and “commerce” are both permeating the most widely used social and e-commerce platforms, and that brand-new “native” social commerce platforms are emerging in the middle where existing platforms are not able to bridge the gap. The “social commerce” pie is therefore growing over time, as illustrated in Exhibit 2.

The exhibit above hints at how social commerce can be sized – by adding up everything that’s inside the circle. We will cover that in more detail later on. For now, all we can say is that we expect this trend to continue in the coming years.

Let’s now try and understand more clearly what’s inside this circle, the specific features or elements that make this form of commerce “social”.

The 4 archetypes of social commerce in Southeast Asia

The clearest way to define the social commerce landscape is through archetypes. Bain took a similar approach in their 2020 India Future of Commerce report, categorizing social commerce along 5 archetypes. This makes for a helpful reading since the South Asian e-commerce market bears some resemblance to the dynamics of Southeast Asia. Other sources like Grand View Research also have 5 archetypes, where Accenture is using 10.

We define the social commerce landscape through the following four archetypes. In management consulting lingo, these archetypes may not be ME (mutually exclusive), but we believe they are CE (collectively exhaustive). Let us know if you think otherwise.

1. Liveselling

Transactions directly influenced by live streaming. The cart assembly and check-out can happen either on the same platform or on a separate platform (i.e Shopee or brand website), as long as live streaming improves awareness or consideration.

Example: Uniqlo Thailand leverages liveselling on Facebook to drive ecommerce sales. Streams are available on Facebook and Uniqlo’s website and are powered by the tech enabler Bambuser. Link

2. Conversational commerce

Transactions directly influenced by a conversation, typically through platforms like WhatsApp, LINE, and Zalo. The cart assembly and check-out can happen either on the same platform or on a separate platform (i.e Shopee or brand website), as long as the conversation improves awareness or consideration.

Example: Boutique bakery Bake It Batter uses conversational commerce through Instagram and WhatsApp to offer personalized cakes for delivery. Link

3. Community group buying

Transactions where the assembly of a group unlocks either a deal, savings on delivery, or access to an otherwise unavailable product. The end-to-end purchase journey can happen on a native platform or organized informally in a group chat on platforms like Viber and WhatsApp.

Example: Mio resellers promote deals on fresh produce and FMCG products to their friends, family members, and neighbors through platforms like Facebook, TikTok, Instagram, or Zalo. They then place and manage the bulk group order through Mio’s reseller app. Link

4. Social platform selling

Transactions where the critical parts of the purchase journey (for example , cart assembly and check-out) happen inside a social platform like Facebook, WhatsApp, or TikTok. This includes scenarios where the user gets taken to another website for payment, but excludes scenarios where social platforms are used for advertisements that take the buyer out of the social platform for the rest of the purchase journey.

Example: Garnier Indonesia selling beauty products through TikTok Shop where the entire e-commerce journey is contained within TikTok. Link (Indonesia-only)

The best social sellers grow through trust, service and entertainment

All six archetypes, and particularly archetypes 1-3 which are based on distinct shopping journeys, stand out from regular e-commerce by introducing a higher level of trust, familiarity and human connection. We believe that this element of service, along with attractive deals and promotions, is the most important success factor for social commerce today.

Our research of the Southeast Asia social commerce market validates this hypothesis. Among Microsellers, which we define as the subset of social sellers who have 1-5 employees and a very low annual turnover, we’ve observed a tendency to start out in an undifferentiated and highly competitive selling environment like Shopee or Lazada, and then over time differentiate by entering other social commerce archetypes like liveselling or conversational commerce.

What we’re doing next

We believe the four archetypes above are an exhaustive representation of what social commerce in Southeast Asia is today. While we’re certain new experiences and journeys will emerge in the future, we believe there is value in opening up each of these archetypes with sizing, examples, and go-to-market best practices for brands and retailers.

We will publish our full dataset and case study library in the 2022 Southeast Asia Social Commerce report in Q4, but in the meantime, we’ll dive further into each archetype right here on the blog. Our next posts will detail liveselling and conversational commerce.