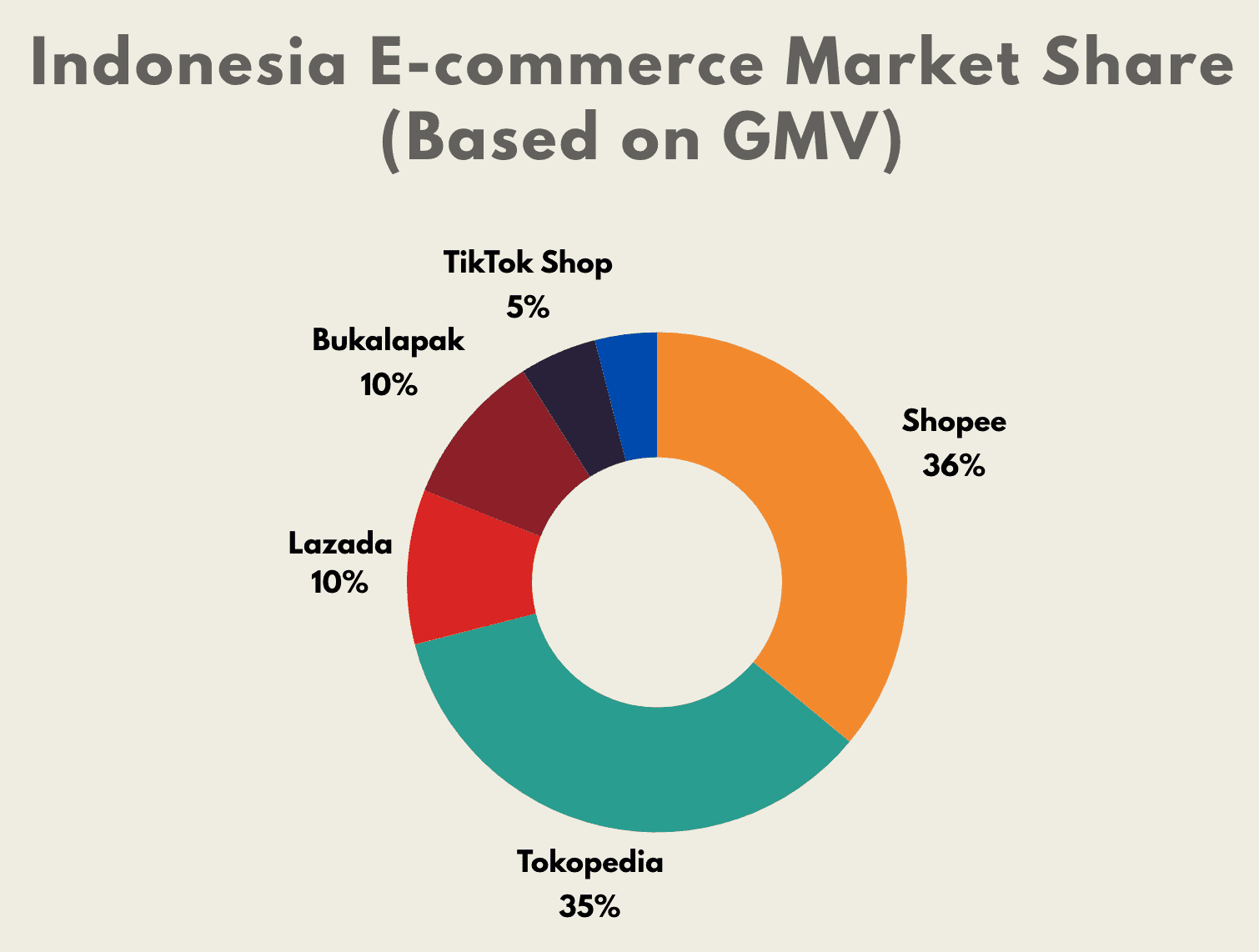

Tokopedia is one of the largest e-commerce players in Indonesia, capturing 35% of the market share and provides insights into the competitive and dynamic e-commerce landscape unfolding among the biggest market in Southeast Asia. The e-commerce platform was founded in 2009 and is now part of GoTo, the holding company formed post Tokopedia’s merger with Gojek in 2021.

Let’s look at how Tokopedia, a 15-year-old e-commerce platform, became one of the leading players in the Indonesian e-commerce market and its challenges ahead.

Tokopedia’s Rise to the Top

Tokopedia was founded by William Tanuwijaya and Leontinus Alpha Edison in 2009. Their vision was to help connect businesses and people in Indonesia, a country spread out across 17,500 islands.

That’s how a C2C marketplace was formed. In their own words, the aim was to “democratize commerce through technology.”

Tokopedia started as a C2C platform allowing individuals to set up online shops and sell products. Eventually it supported B2C transactions allowing businesses, ranging from small enterprises to large brands, to reach a broad consumer base.

And 15 years later, Tokopedia is now toe-to-toe with Shopee to be the largest e-commerce player in the country.

Today, Tokopedia has its presence in 99% of the cities in Indonesia, 1.8 billion products listed, more than 14 million registered merchants, and 60% of orders are delivered no later than the next day.

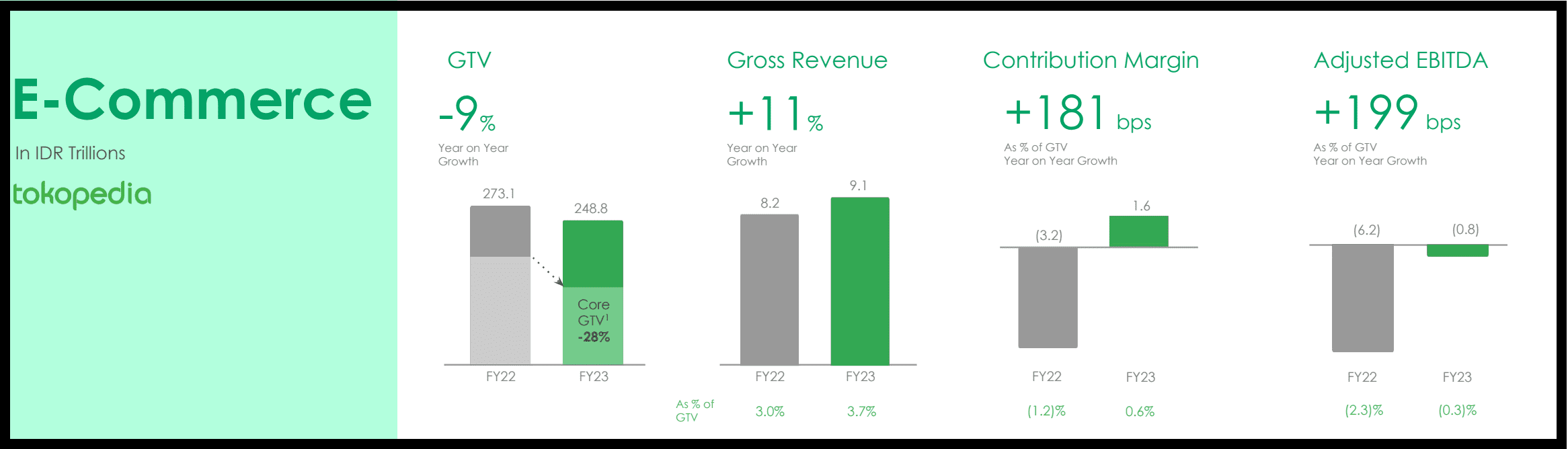

The same stellar results show in the financials as well. Tokopedia’s revenue reached IDR 9.1 Trillion (~$560 Million) for FY2023, up 11% from FY2022.

Image Source: 2023 Q4 Results, GoTo

However, the Gross Transaction Value (GTV) has seen a degrowth of 9% from IDR 273 trillion in FY2022 to IDR 249 trillion in FY2023. Nevertheless, if you look at the big picture and Tokopedia’s growth over the decade, it has been nothing but phenomenal.

Business Growth Drivers

Here are the key growth drivers responsible for Tokopedia’s rise to the top over the years.

#1. The thriving e-commerce market in SEA and Indonesia

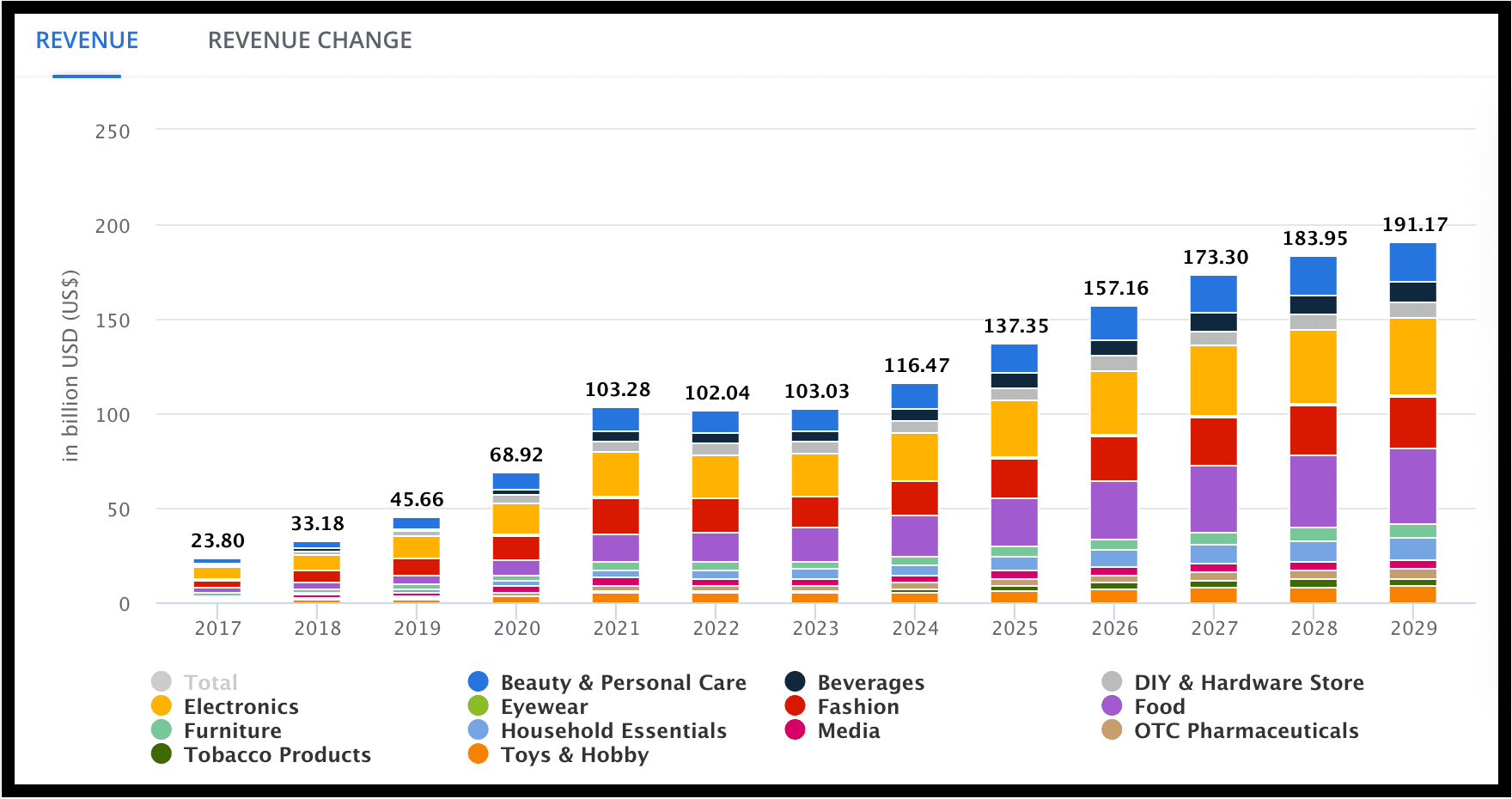

Southeast Asia (SEA) has witnessed a phenomenal rise in e-commerce in the last decade. The e-commerce market is estimated to be $116.5 Billion in 2024 and is expected to hit $191 Billion by 2029 at a CAGR of 10.4%.

Image Source: Statista

It is not just the SEA region. Indonesia itself has seen rapid growth in the e-commerce market in the last decade.

Indonesia’s e-commerce market reached a market size of USD 52.93 billion in 2023, making it the largest e-commerce market among ASEAN countries. In total, the e-commerce market in ASEAN countries is estimated at USD 99.5 billion, which means Indonesia accounts for 52% of the market size.

#2. Topline growth over profitability

Profitability has not been the primary driver for Tokopedia. Rather, the revenue growth is. This is the playbook that most e-commerce and new-age tech startups follow across the world — revenue growth over profitability. And it clearly shows in Tokopedia’s revenue as well, reaching IDR 9.12 trillion in FY2023.

Image Source: 2023 Annual Report, GoTo

Over the years, Tokopedia has secured funding of over $2 billion from SoftBank, Alibaba Group Holdings, Temasek Holdings, and others. Giving them the freedom to aggressively pursue business growth by sacrificing profitability.

Tokopedia was one of the first e-commerce players in Indonesia. Its early entry into the market propelled the platform to establish a strong brand presence and a user base. To establish such a presence across the country, Tokopedia has to prioritize revenue growth over profitability. And so far, it has worked out exceedingly well with the platform gaining a 35% market share in the country.

#3. Strategic Partnerships

Tokopedia has never shied away from strategic partnerships that allow the platform to grow further. Be it their collaborations with JNE, J&T Express, and SiCepat for logistics, with OVO for streamlined payment processes, with Telkom for digital infrastructure, or many more.

But two main standout partnerships include – its merger with Gojek, and the merger with TikTok Shop.

Tokopedia merged with Gojek in 2021, which saw two unicorn companies coming together to form an internet behemoth. The combined entity featured 100 million monthly active users (MAU) and a GTV of over $22 billion. Post the merger, GoTo Group was formed as a parent company under which these platforms were named subsidiaries.

Post TikTok Shop’s ban in Indonesia in 2023, the company was soon in talks with Tokopedia. This resulted in Tokopedia absorbing TikTok Shop’s Indonesia business and TikTok investing over $1.5 billion to gain a controlling stake in the merged entity.

Such malleability in its partnerships is one of the main reasons for Tokopedia’s growth in Indonesia’s e-commerce market. As the founder, William Tanuwijaya, says, “Our philosophy has always been to find the right partners and grow together.”

#4. User-friendly platform, robust logistics, and integrated payment solutions

Tokopedia provides a seamless UX experience for both the buyer and the seller. According to Tokopedia data, 76.4% of sellers on the platform find it easy to set up their business on the platform and sell their products.

The logistics network is strong as well, with more than 60% of orders delivered within the next day. Tokopedia has integrated Gojek’s logistics services – GoSend to offer same-day delivery options, improving customer satisfaction with faster delivery times.

With digital payments exploding, integrated payment solutions are seen as necessary across e-commerce platforms. And Tokopedia is not behind either. The platform has integrated digital payments and has partnered with OVO and GoPay (adding synergistic benefits post the Gojek merger) for streamlined payment processes.

All these factors, which are the running parts of the platform, have added up in increased customer satisfaction and higher user base. The high-quality product offering in itself has fuelled Tokpedia’s growth over the years.

#5. Competitive edge in localized approach

Despite the presence of big players like Shopee and Lazada, Tokopedia has grown as a major e-commerce player in Indonesia.

Even though Shopee still leads the market with 36% market share, Tokopedia is right behind with a share of 35%, followed by Lazada and Bukalapak with 10% each.

Data Source: International Trade Administration

While Shopee is known for its aggressive marketing and promotional strategies; and Lazada for its Alibaba-backed robust logistics, Tokopedia excels in a localized approach.

It is the indigenous e-commerce player much more in tune with the Indonesian market. The platform focuses heavily on local sellers and caters specifically to Indonesian market needs, leading to a strong connection with the local consumers.

Considering Tokopedia’s merger with TikTok Shop Indonesia business, it is highly likely that Tokopedia will overtake Shopee to become the market leader in the future.

Challenges Ahead

With such a rapid rise in the e-commerce space, Tokopedia’s path forward is not without its challenges, though. These include:

- Stiff competition: Shopee and Lazada are the biggest competitors with Shopee being the market leader (36% against Tokopedia’s 35% market share). Both these platforms have the added advantage of expanding presence across the SEA region, whereas Tokopedia is largely limited to Indonesia only.

- Profitability: Tokopedia is yet to churn out profits despite being 15 years in operation. While in the initial years of sacrificing profitability for topline growth is justifiable, with the market saturation and stagnant growth – the pressure to show profits has increased.

- Growth stagnancy: Tokopedia is already experiencing stagnant growth. There is market saturation, especially in urban areas, and the company has to look for new growth avenues. The platform’s GTV has already seen a decline of 9% in FY2023. The need for exploring new markets for further growth is more than ever.

Wrapping Up

While there are challenges and roadblocks ahead for the e-commerce giant, Tokopedia seems to be entering an exciting year ahead with its recent merger with TikTok Shop’s Indonesia business and TikTok gaining a controlling stake in the company. As the market matures, Tokopedia must innovate and explore new growth avenues to maintain its competitive edge.