Vietnam e-commerce insights reveal a booming online market penetration, driven by rapid growth and changing consumer behavior. This dynamic environment is dominated by several key players who have secured strong positions. You’ll encounter a blend of local champions and international giants, all competing for a share of the lucrative e-commerce market.

The Big Players: Who’s Leading the Pack?

Source: decision lab

Shopee: The People’s Favorite

Shopee has been operating in Vietnam since 2016 and now has become the largest player of e-commerce market in the country. You’ve probably seen their vibrant ads and catchy jingles all over social media.

Shopee, often regarded as the people’s favorite, shines in user engagement and promotional activities. They are masters of the flash sale, and their app is buzzing with activity. You can find anything from fashion to electronics, all at competitive prices.

Their success lies in its ability to connect buyers and sellers efficiently, making online shopping easy and enjoyable for everyone. With their innovative marketing strategies and customer-centric approach. They also know how to keep you coming back for more with their gamified shopping experience.

However, no one is perfect. Shopee struggles with delivery speed and customer service issues. Sometimes, products take longer to arrive, and getting a quick resolution for complaints can be challenging. Despite these hiccups, Shopee remains a strong contender in the Vietnam e-commerce arena.

Lazada: The E-commerce Veteran

Another powerhouse in Vietnam’s e-commerce arena is Lazada. If you’re looking for a reliable platform with a vast selection of products, Lazada is your go-to. With its strong backing from Alibaba, they are like the wise elders in the Vietnam e-commerce market. They have been around longer than most, and this experience shows in their operations.

Lazada’s strengths include a vast product range and strong logistical capabilities. You can rely on them for relatively quicker deliveries and a broader selection of goods. On the flip side, Lazada’s user interface can be a bit clunky. You might find yourself frustrated with occasional technical glitches.

Additionally, their customer service isn’t always up to par. These weaknesses slightly dim their shine, but Lazada’s robust logistics network keeps them in the game.

Tiki: The Local Hero

Tiki stands out as the local hero among Vietnam e-commerce platforms. Born and bred in Vietnam, they understand the local market better than its foreign competitors. Founded in 2010 and started as an online bookstore, Tiki has expanded into various product categories, offering everything from electronics to fashion.

Tiki commitment to authentic products and excellent customer service has earned them a loyal customer base. Their strengths lie in their focus on quality and fast delivery. TikiNow, part of Tiki service, promises lightning-fast delivery, sometimes within two hours! You also get a sense of supporting local businesses when shopping on Tiki.

Yet, Tiki’s smaller scale compared to Shopee and Lazada can be a disadvantage. Their product range isn’t as extensive, and they may lack the same level of promotional prowess. If you’re looking for a wide variety of international brands, Tiki might not always meet your needs. Nonetheless, their dedication to quality and speed makes them a formidable competitor.

Rising Stars and Innovators

While Shopee, Lazada, and Tiki are leading the pack, several emerging players are making waves in the Vietnamese e-commerce market. These rising stars are bringing fresh ideas and innovative solutions to the table, challenging the established giants.

Sendo: The Community-Centric Platform

Sendo is an up-and-coming e-commerce platform that’s gaining traction in Vietnam. You’ll love their localized approach, focusing on the specific needs and preferences of Vietnamese consumers.

They offer localized promotions, celebrate national holidays with special deals, and prioritize customer service that speaks to the local community. Their platform is designed to cater to a broad spectrum of customers, from urban dwellers to rural shoppers.

Sendo’s commitment to supporting small and medium-sized enterprises (SMEs) also resonates well with local sellers. By providing a platform where local businesses can thrive, Sendo is fostering a diverse and dynamic marketplace.

Gioi Di Dong: The Tech Haven

Then there’s The Gioi Di Dong, or Mobile World, which started as a retail chain for electronics but has successfully transitioned into e-commerce. If you’re tech-savvy and looking for the latest gadgets, this is the place to be.

Their online platform offers a seamless shopping experience, with detailed product descriptions and customer reviews. The Gioi Di Dong’s focus on quality and customer satisfaction has helped them carve out a niche in the competitive e-commerce market.

TikTok Shop: Social Commerce pioneer

A new player shaking up the Vietnamese e-commerce scene in 2022 is TikTok Shop. Combining social media and e-commerce, TikTok Shop has quickly become a favorite among younger consumers.

TikTok Shop leverages the platform’s massive user base and highly engaging content to drive sales directly from videos. Influencers and brands showcase products in creative ways, and you can purchase items with just a few taps.

TikTok Shop’s entry into the Vietnamese market represents a significant shift towards social commerce. As more consumers, especially the younger generation, prefer shopping through social media, traditional e-commerce platforms are facing new competition. This trend is likely to continue growing, making TikTok Shop an essential part of the e-commerce landscape in Vietnam.

Understanding the Local Market

Vietnamese consumers have specific preferences and shopping habits. For example, they tend to trust local brands more than international ones. This is why it’s essential to build trust from the get-go. Researching consumer behavior is your best starting point. Look into what products are popular, which payment methods are preferred, and how often people shop online.

Source: decision lab

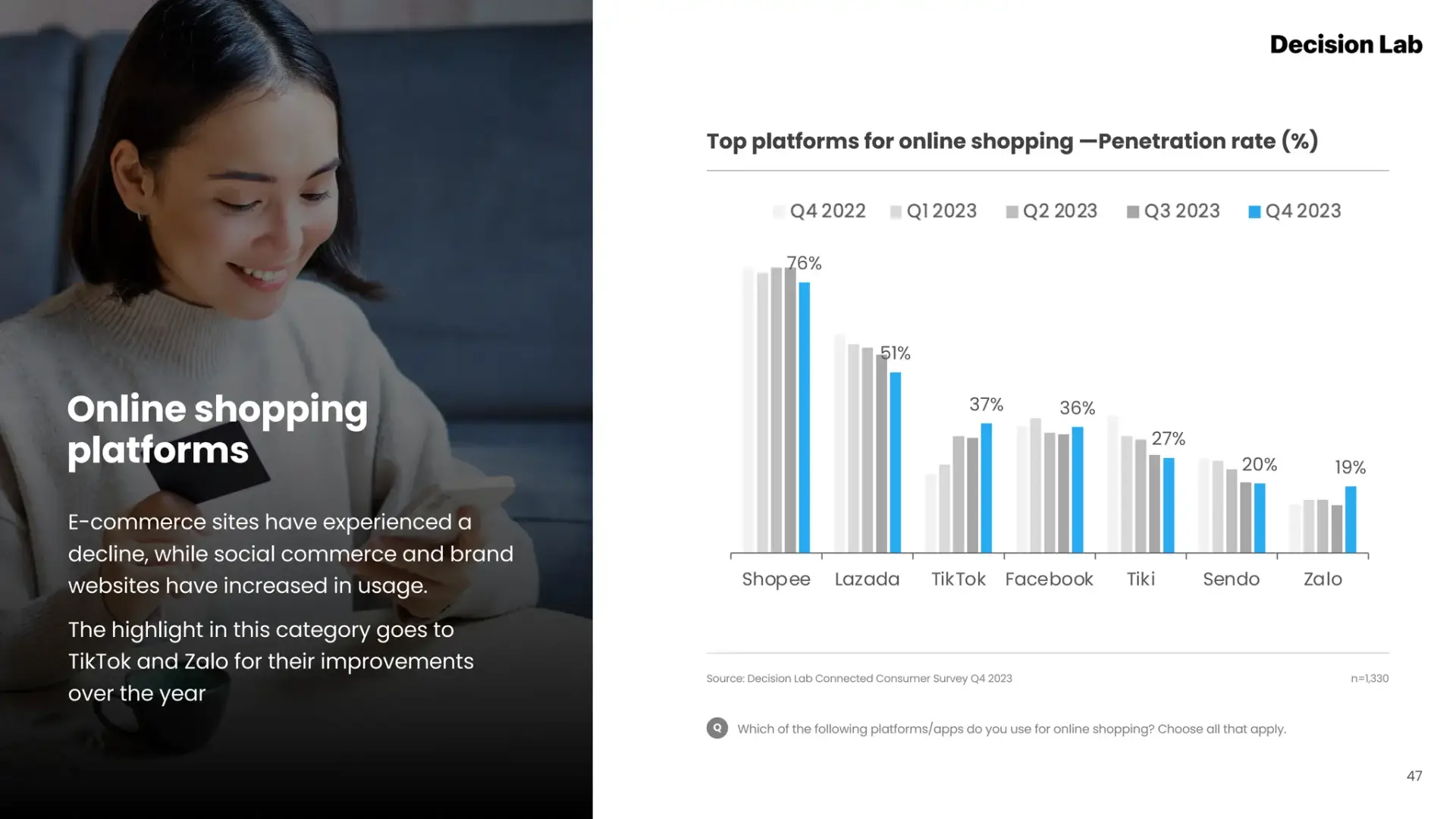

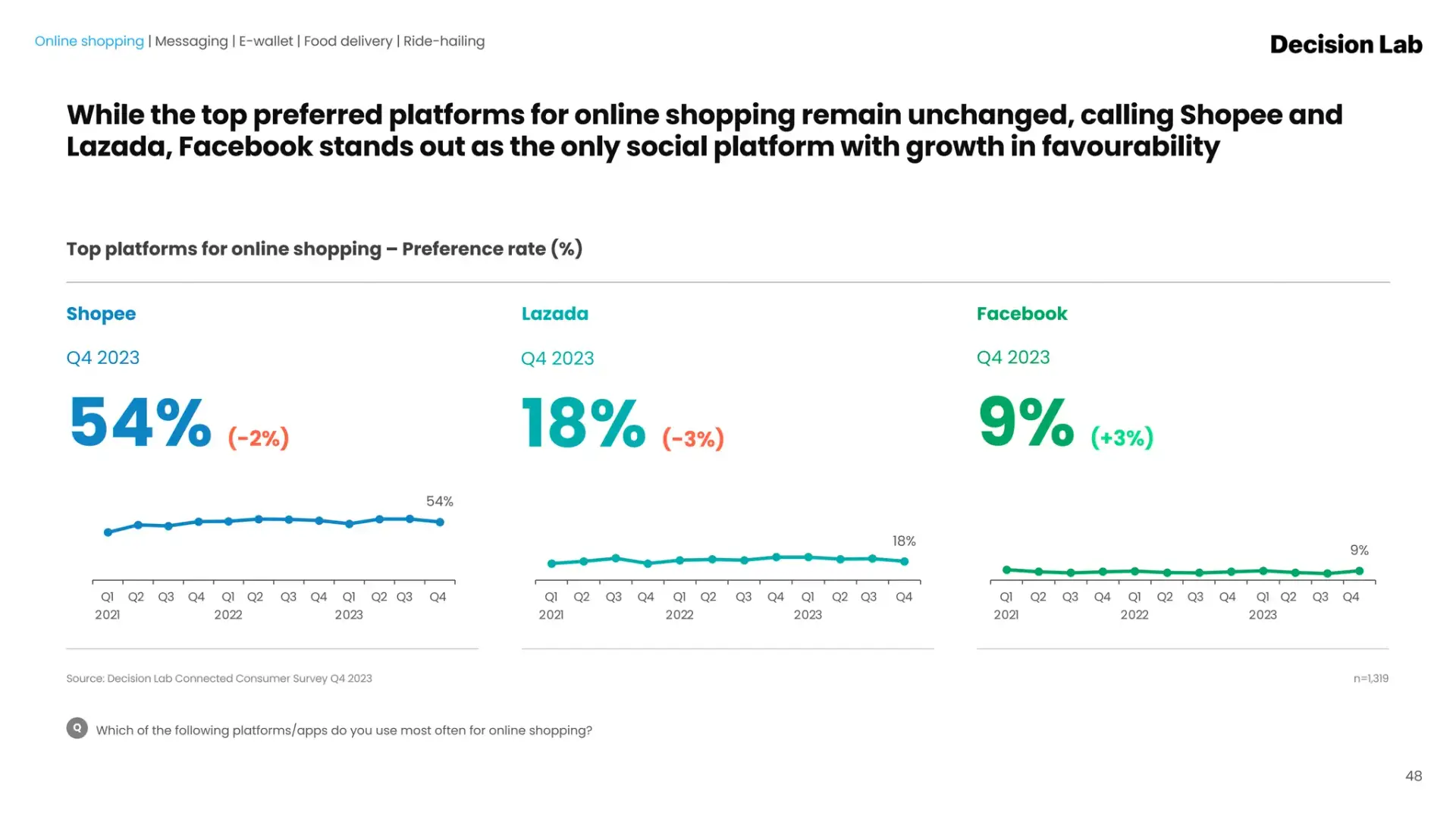

Additionally, you’ll find that Vietnamese consumers are very active on social media. Platforms like Facebook, Zalo, and Instagram are incredibly popular. In fact, Facebook is the only social media platform that has also become top preferred online shopping and received 9% growth in Q4 of 2023.

Payment methods are another crucial aspect of localization. Vietnamese shoppers prefer cash on delivery (COD), although online payment methods are becoming more popular. Offering a variety of payment options can make your brand more accessible and trustworthy.

Flash Sales and Promotions: A Game of Numbers

Another crucial aspect of market share distribution in Vietnam’s e-commerce scene is the role of flash sales and promotions. Since Vietnamese consumers are also very price-sensitive. Offering competitive pricing, discounts, and promotions can attract more customers.

These events are incredibly popular among Vietnamese consumers, who love a good deal. Shopee and Lazada frequently hold massive sales events, such as the 11.11 (Singles’ Day) and 12.12 (Double 12) sales, drawing millions of shoppers.

These sales events not only boost short-term sales but also increase customer retention. Tiki and Sendo also participate, although their scale is comparatively smaller. The success of these promotions highlights an important Vietnam e-commerce insight: competitive pricing and attractive deals are key to capturing market share.

Vietnam’s E-Commerce Trends

As we look ahead, the Vietnamese e-commerce market shows no signs of slowing down. With increasing internet penetration and a growing middle class, more and more consumers are turning to online shopping for their needs.

One of the key trends shaping the future of Vietnam’s e-commerce market is the focus on enhancing user experience. Companies are investing in technology to make online shopping more convenient and enjoyable.

Mobile Commerce Dominance

E-commerce platforms are optimizing their mobile apps to provide a seamless shopping experience. Whether you’re browsing products or making a purchase, everything is just a tap away. This shift towards mobile commerce is set to revolutionize how you shop online.

A significant portion of e-commerce transactions in Vietnam occurs on mobile devices. According to recent data, around 57% of online purchases are made via smartphones.

This mobile-first approach is largely driven by the younger population, which is tech-savvy and prefers the convenience of shopping on the go. Shopee, in particular, has capitalized on this trend, offering a seamless mobile app experience that keeps users coming back.

The Emergence of Social Commerce

Social commerce is taking off in Vietnam, with platforms like Facebook and TikTok Shop becoming popular shopping destinations. You’ll find a variety of businesses selling products directly through social media. This trend is particularly appealing to younger consumers who spend a lot of time on these platforms.

Purchases made via the search feature on TikTok Shop surged by 32 times, showing that users are deliberately searching for products on the platform rather than impulsively buying items they come across while scrolling through videos.

Cross-border E-commerce: Expanding Horizons

Another factor influencing market share distribution in Vietnam, Cross-border e-commerce which shows a growth rate 2.3 times quicker than regular e-commerce from 2022 to 2025.

Starting in 2019, Vietnamese businesses have greatly expanded their global reach, with the number of products exported through international e-commerce platforms rising by 300%.

Vietnamese consumers are increasingly buying products from international sellers, driven by the desire for a wider variety of goods and competitive prices. This trend is particularly notable in categories like fashion, electronics, and beauty products.

Cross-border e-commerce currently accounts for about 37% of total online sales in Vietnam. This figure is expected to grow as more consumers become comfortable with purchasing from overseas and as logistics and delivery services improve.

Threats and Challenges: Potential Hurdles in the Market

In the bustling world of Vietnamese e-commerce, navigating the choppy waters isn’t always smooth sailing. Here are some potential hurdles you might encounter:

#1. Regulatory Rapids: Navigating Legal Currents

Vietnamese lawmakers are revising the value-added tax (VAT) on goods imported through e-commerce platforms. Historically, the number of low-value orders entering Vietnam was not significant. However, due to the recent surge in cross-border e-commerce, this number has increased dramatically, according to an official.

Data from the state-owned Vietnam Posts and Telecommunications Group (VNPT) revealed that in March 2023, an average of four to five million orders were transported from China to Vietnam daily. Each order had a value from VND100,000 ($3.9) to VND300,000 ($11.7). This results in an estimated daily circulation of goods valued between $45 million and $63 million on these e-commerce platforms.

#2. Counterfeit Goods: Implementing Consumer Protection on E-Commerce

Counterfeiting remains a significant challenge in Vietnam. They can include a wide range of products, from luxury items and electronics to everyday consumer goods. The rise in online shopping has made it easier for counterfeiters to distribute fake products, making it difficult for consumers to distinguish between genuine and counterfeit items.

On June 20, 2023, the National Assembly approved the Law on Protection of Consumers’ Interests No. 19/2023/QH15, which will come into force on July 1, 2024. This law necessitates an immediate review, revision, and addition of regulations concerning administrative violations in consumer protection, as specified in Decree 98.

Wrap up

Despite the opportunities, there are challenges to be aware of. The regulatory environment in Vietnam can be complex, with different rules and requirements for foreign businesses. Logistics and supply chain management can also be challenging, especially in rural areas.

Lastly, competition is fierce. Both local and international brands are vying for a share of the growing e-commerce market. Understanding the distribution of market share in Vietnam’s e-commerce landscape is key to gaining valuable insights into this dynamic industry.