With the global value of social commerce set to reach an astounding value of $2.9 trillion by 2026, the world is seeing a sweeping rise of a new era of shopping.

Southeast Asia is rapidly positioning itself as a global hub for this emerging way of shopping, called social commerce, and, in 2024, Shopify revealed that 68% of Southeast Asian e-commerce retailers were planning to invest more in social commerce.

From the rise of live shopping events to shoppable posts, Southeast Asia is at the forefront of digital commerce. But what exactly is driving this growth, and what lies ahead for brands looking to capitalize on this shift? In this article, we’ll explore the trends that are making this growth possible and the future potential of social commerce.

What is Social Commerce?

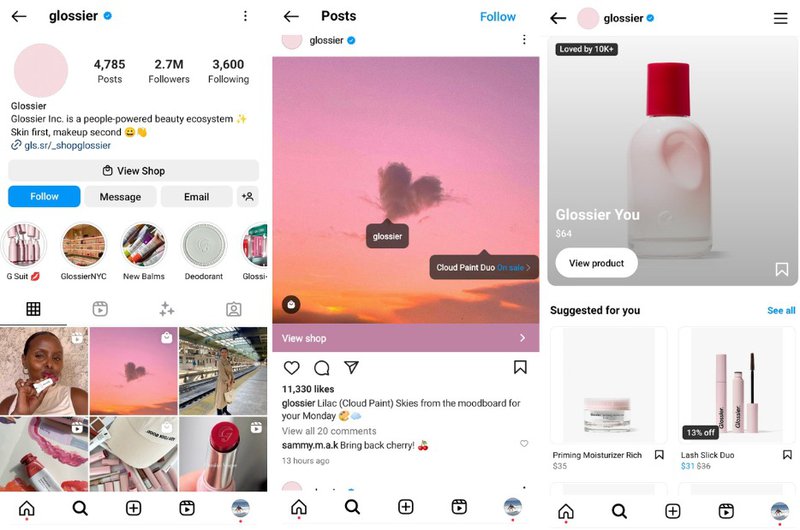

Image Credit: Respond.io

Social commerce refers to selling products directly through social media platforms. The entire shopping experience—from product discovery to purchase—happens within the app. Often, social commerce works through a brand or influencer’s posting of a product, and then their audience purchases the item through an online storefront without ever leaving the app.

Social media is a key driver of purchases as 82% of consumers discover new products via online platforms. The convenience of social commerce is uncontested, and consumers are responding. TikTok Shop, another widely used e-commerce app, expects to find an 11.3% increase in their Asia-Pacific user base in 2024.

In contrast, traditional e-commerce takes place on dedicated websites or apps designed solely for shopping like Amazon. On traditional e-commerce sites, consumers often come with a specific intention—searching for a product, comparing prices, or reading reviews from verified purchasers.

The key difference lies in product discovery: Social commerce integrates it seamlessly into social interactions, while traditional e-commerce typically requires intentional searches.

Social Commerce Growth in SEA: Social Commerce GMV Expected to Reach $85 Billion by 2027

The growth of social commerce is driven by the region’s high smartphone penetration and widespread social media usage and penetration rates range from 68.9% to 91.7% in the region.

Each country in the region is on a unique growth trajectory. In Vietnam, an emerging market expected to double its e-commerce value by 2030, about 51% of young shoppers reported using social commerce to purchase fashion accessories, one of the most common e-commerce purchases in the region.

Overall, the region’s social commerce GMV is projected to see a total value of $85 billion by 2027.

Key Drivers of Social Commerce Growth in Southeast Asia: Mobile Commerce and Social Media

Several key factors have significantly contributed to the growth of social commerce in the region:

- Mobile-first economy: Southeast Asia is characterized by a mobile-first approach, where a significant portion of the population relies on smartphones as their primary device for internet access. As smartphone adoption continues to rise, more people are shifting their shopping behaviors online, using apps and social media to discover and purchase products, making mobile commerce a key driver of growth.

- Youth population & social media dominance: Gen Z and Millennials are highly active on social media and are early adopters of new trends. This demographic is fueling the growth of social commerce through their engagement with digital content.

- Trust in peer recommendations and influencers: Social commerce thrives on the trust that consumers place in peer recommendations and influencers. People are more likely to purchase products endorsed by people they follow, creating a personalized and trusted shopping experience. Influencers have a solid footing in the region, with 31.1% of Indonesians, 24.1% of Thais, and 20.9% of Vietnamese consumers reporting engaging with influencers.

- Growth of live commerce: Live commerce is rapidly growing, where brands and influencers engage directly with customers in real-time through live-streaming. This creates a sense of urgency and excitement, and shoppers can ask questions and see product demonstrations before making a purchase. Leading e-commerce platforms in Southeast Asia, such as Shopee and Lazada, have integrated live-streaming into their apps.

Top Emerging Trends in Southeast Asia’s Social Commerce

Here are the upcoming trends that are rising in popularity:

1) Live shopping events

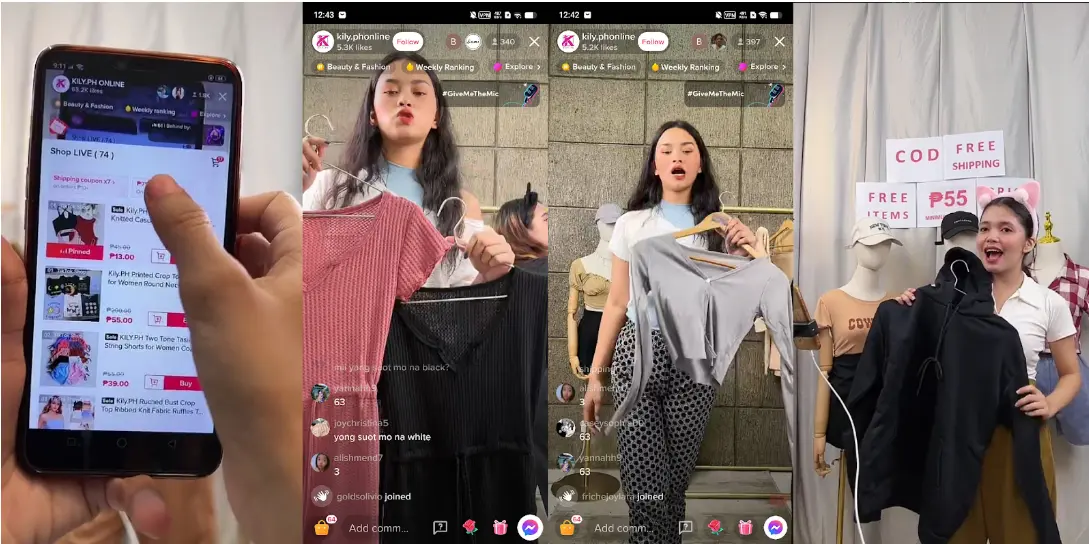

Image Credit: Converted.in

Live shopping– or what some are calling “shoppertainment”– is now a major trend, where both brands and influencers use live-streaming to promote products in real-time. This format allows consumers to view product demonstrations, ask questions, and interact directly with the host, creating a dynamic and engaging shopping experience. These events often feature limited-time promotions, flash sales, and real-time Q&A sessions, encouraging viewers to make quick purchase decisions and driving high levels of engagement.

2) Micro and nano influencers

Image Credit: Socialnative

A research report from Cube has indicated that 82% of consumers in Southeast Asia purchased an item based on an influencer’s recommendation. It is clear that influencers’ endorsements hold weight for consumers–whether they have millions of followers or a couple hundred.

However, the recommendation power of an influencer fluctuates with the size of their following. It also mentioned, Southeast Asian consumers trust mega influencers (those with over one million followers) the most and tend to have a stronger impact on purchasing decisions. Their ability to influence purchasing beat that of celebrities.

In contrast to macro-influencers with millions of followers, micro and nano-influencers are gaining popularity due to their deeper connections with their audiences. These influencers typically operate within niche markets, and their content feels more personal and authentic, making them highly effective for driving product recommendations. Nano influencers experienced the highest growth in 2024 in consumer trust and saw a year-over-year 3% increase in positive impact on purchase decisions.

3) Region-specific payment solutions

Image Credit: Komoju

As social commerce grows in the region, so does the need for seamless, localized payment solutions. In 2023 alone, the region recorded 645.8 billion non-cash transactions–and it set to outpace cashless transactions in Europe and North America combined.

Mobile wallets and e-wallets such as GoPay, GrabPay, and ShopeePay are becoming increasingly popular, providing fast and convenient payment options for shoppers across the region. These digital wallets, popular especially among the younger generations, are integrated into many social platforms and e-commerce sites. In 2023, 79% of consumers reported using a mobile wallet, making it the most used form of payment.

Despite the rise of digital payments, many (up to 77%) consumers in Southeast Asia still prefer cash-on-delivery (COD) options, especially in areas with limited access to banking infrastructure. Offering COD as a payment method helps brands reach a wider audience and build trust with customers who may be wary of online transaction fraud.

4) Social-driven product discovery

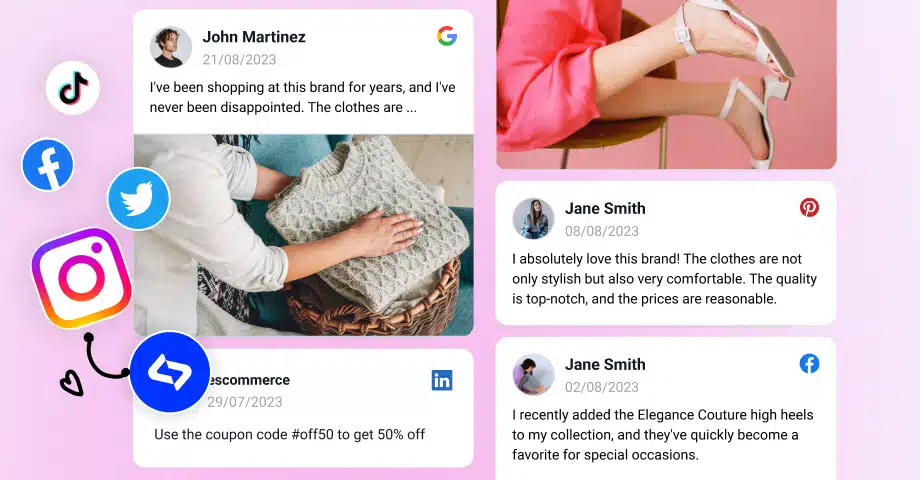

Image Credit: Embedsocial

Social media is becoming the primary channel for product discovery with more than 4 out of 5 consumers discovering new products through social platforms, where they are exposed to recommendations from influencers, friends, and brands.

To capitalize on this shift, brands are creating shoppable posts and leveraging targeted ads on platforms like Instagram, Facebook, and TikTok. These features allow consumers to purchase products directly from their social media feeds, streamlining the path from discovery to purchase. This trend has further blurred the line between social interaction and online shopping, making social media a crucial part of the e-commerce ecosystem.

Challenges Facing Social Commerce in Southeast Asia

- Trust and Security Concerns: Many shoppers are worried about counterfeit products and fraudulent sellers. To build consumer confidence, platforms need secure payment methods and better seller verification, like badges for trusted sellers and buyer protection guarantees.

- Logistical Challenges: Southeast Asia’s geography has a mix of islands, rural areas, and big cities, which makes it tough for deliveries. Additionally, shipping across borders brings complexities like customs rules and varying delivery timelines, making it harder for both businesses and customers.

- Regulatory and Compliance Issues: Each country in Southeast Asia has its own laws regarding taxes, privacy, and consumer protection. Social commerce businesses need to understand and follow these different rules to stay compliant. Data privacy laws, especially concerning how personal data is stored and used, add more challenges when operating across multiple countries.

Strategies for Brands to Succeed in Social Commerce

If your focus is on Southeast Asia and you’re looking to improve your brand, do the following:

1) Build trust through verified sellers and review

Image Credit: Freepik

Trust is a critical factor in social commerce. You can enhance credibility by offering verified seller badges that signal authenticity and reliability to shoppers. Additionally, implementing reliable review systems where your customers can leave feedback provides transparency and helps potential buyers make informed decisions. Encouraging customers to share user-generated content and reviews further strengthens trust.

2) Leverage influencer collaborations

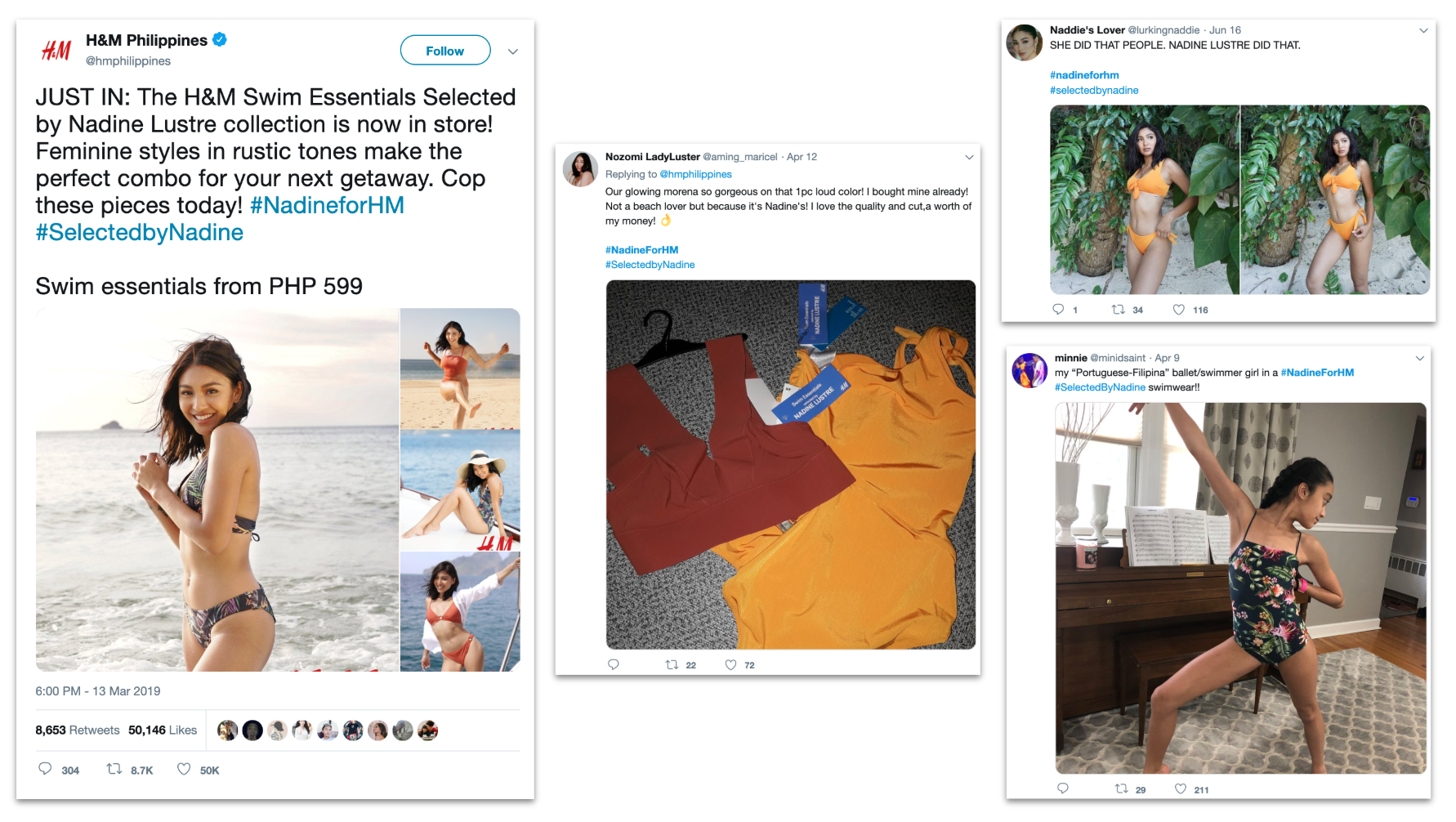

Image Credit: LinkedIn (Gabriel B. Del Carmen)

Influencers play a pivotal role in social commerce by creating authentic and relatable content that resonates with their audience. Focus on partnering with influencers who align with your values and products, leveraging their reach to engage target customers in a more personal way.

Instead of focusing on one-off promotions, aim to build long-term relationships with influencers. Ongoing partnerships create a consistent narrative and more genuine brand endorsement, increasing the likelihood of sustained engagement and sales.

3) Embrace live commerce

Images Credit: TikTok Shop

Live-streaming offers a unique, interactive way to showcase products and connect with potential buyers in real-time. By hosting regular live commerce events, you can create engaging experiences where viewers can ask questions, see product demonstrations, and make purchases instantly.

To incentivize participation, businesses can offer exclusive deals, limited-time offers, or flash sales during live streams. Interactive experiences, such as live Q&A sessions, polls, or giveaways, keep the audience engaged and encourage immediate purchasing behavior.

4) Adopting omnichannel strategies

Image Credit: Sephora

Adopting an omnichannel strategy means creating a cohesive and consistent brand experience across all digital touchpoints. This goes beyond simply being present on multiple platforms—it’s about ensuring that the customer’s interaction is smooth, regardless of the channel they choose.

By providing various touchpoints for discovery (e.g., social feeds, influencer posts), engagement (e.g., comments, reviews, and live sessions), and purchase (e.g., direct links to stores or payment gateways), you help customers transition effortlessly between platforms, reducing friction and increasing the likelihood of conversion.

Final Thoughts

Social commerce is more than just a trend—it’s becoming a fundamental part of the shopping experience.

Brands that succeed in this space aren’t just reacting to trends; they’re building trust by ensuring sellers are verified, engaging authentically with influencers, and tapping into the growing popularity of live commerce. They’re also integrating online and offline shopping channels seamlessly to meet consumers wherever they are.

As the digital landscape evolves, brands that stay ahead by innovating and meeting the unique needs of Southeast Asian consumers will shape the future of shopping in the region. The era of social shopping is here, and businesses that embrace it now will lead in the years to come.