It is easy to see the success of the Southeast Asian e-commerce market through its topline metrics. Since 2020, the Southeast Asian e-commerce market has skyrocketed. It also has become a thriving market expected to reach a value of $116.5 billion in 2024.

However, the region’s market is more than meets the eye. There are aspects of the market that any seller, consumer, or anyone interested in Southeast Asian e-commerce needs to know. Let’s take a look at some statistics that can help anyone understand the state of the region’s e-commerce market.

Top Southeast Asian E-Commerce Statistics You Need to Know

First, let’s look at some top-line statistics. If there is anything that you need to know about this market, it’s this:

- Revenue Growth: E-commerce revenue is projected to show an annual growth rate of 10.42% between 2024 and 2029. If this is accurate, the market could top 191.2 billion dollars by 2029.

- Product Discovery: 57% of Southeast Asian consumers visit e-commerce marketplaces to discover new products. Consumers look to social media channels (50%) second, then to Google search last (40%).

- Consumers are Coming: User penetration could be as high as 29.2% by the end of 2024 and 39.8% by 2029.

- Big B2B Business: Business-to-business e-commerce in the Asia Pacific region has been increasing by an average of 15% annually. This is higher than the global average of 14.5% GMV growth annually.

E-Commerce Statistics by Region

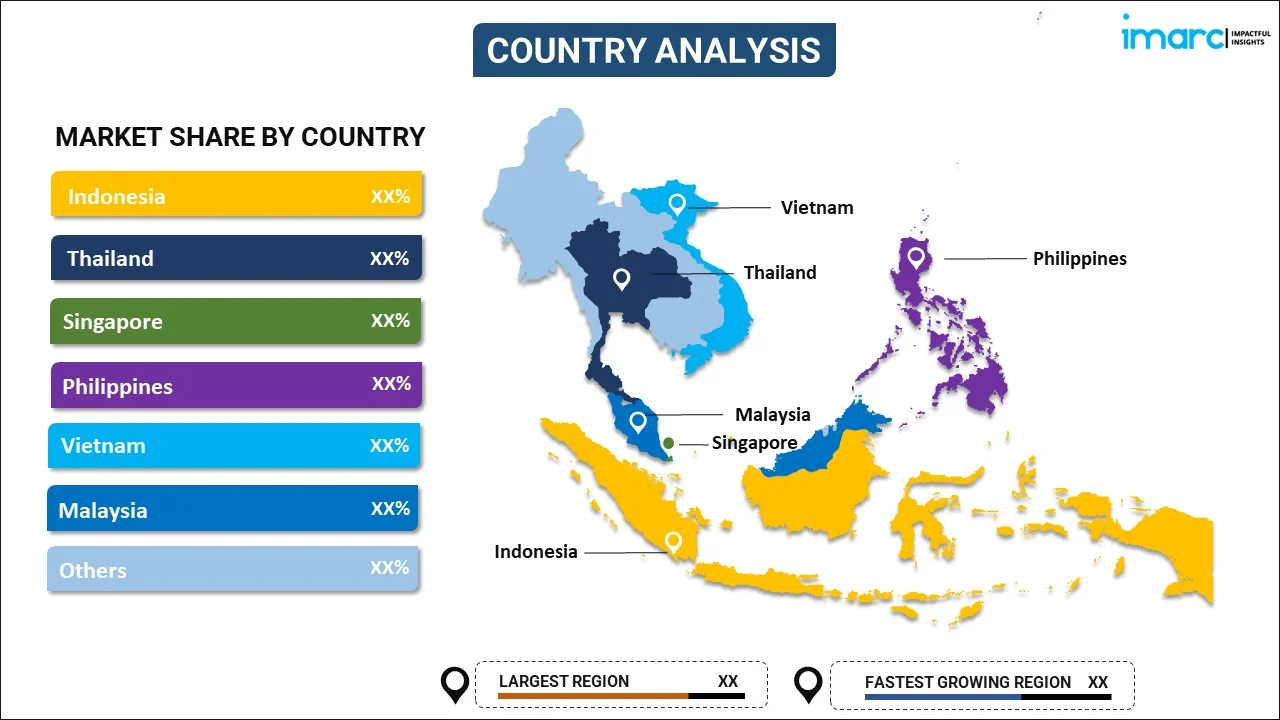

Most analysts refer to the Southeast Asian e-commerce market as the countries of Indonesia, the Philippines, Vietnam, Singapore, and Thailand. Each country is growing at its own pace, and their respective e-commerce economies are maturing at varying rates.

- Most Mature: Indonesia is the largest e-commerce economy in Southeast Asia and represents the largest share of the Southeast Asian e-commerce market. The country’s e-commerce revenue currently contributes about 52% to its overall GMV, and its internet economy was reported as over $82 billion in 2023. Lazada and Shopee reported sales of $1.86 billion in Indonesia, a year-over-year growth of about 84%.

- Up and Coming: Malaysia and Vietnam are some of the fastest-growing e-commerce markets in the world. In fact, Vietnam, Thailand, and the Philippines are projected to double their market values before 2030. Vietnam is particularly seeing a boom in social e-commerce.

It is also important to note the growing emphasis on cross-border e-commerce developments. China is rank at the top in the development index at 71.4. Meanwhile the Southeast Asian countries of Thailand, Malaysia, and Indonesia’s scores fall between 54 and 58.

Image credit: IMARC

Southeast Asian E-Commerce Customer

Customers are different all around the world, and their shopping habits contribute to statistics from the types of products sold down to the breakdown of where they made their purchase.

- User penetration: The Southeast Asian e-commerce penetration rate sits at around 20%. Indonesia and Singapore lead the pack with a 30% penetration rate–double the rate of Vietnam and Thailand. As more consumers are able to reach these markets via the internet, so will their demand for products and streamlined logistics services.

- Popular Products: In 2024, electronics generated the most revenue for sellers. Food, fashion, and beauty and personal care closely followed. These latter categories are expected to see the most growth in the coming years, but all categories will likely see continued increases in sales.

- Generational Differences: E-commerce sellers need to know their customers, and one crucial way to segment a consumer base is by generation. One study found that, in Vietnam, all generations tend to use Shopee as their first choice. Both Gen Y’s and Gen Z’s second choice was Lazada, however, the differences in their choices were significant: 51% of Gen Y chose Lazada, while only 34% of Gen Z opted for that choice.

- Social E-Commerce Statistics

Live shopping is an interactive experience where the sellers advertises customer in a live setting–either on the shopping app itself or on another social media platform. This type of selling is considered more engaging than traditional marketing due to the interactions between the consumer and the seller, or the “influencer.”

This can take many forms and many e-commerce platforms have begun to use their social following to boost sales.

- Social Shopping: A study found that purchases made while viewing a livestream increased by an average of 76% worldwide over the pandemic.

- Part of a Global Movement: The social e-commerce market was expected to hit $126.6 billion in 2024, and Asia was in the lead in terms of adoption and revenue generation.

- Southeast Asian Market is Growing: The social commerce market is forecasted to realize a CAGR increase of 20% to 30% and reach $125 billion by 2027.

E-Commerce Shopping Platform

Of course, there would not be an e-commerce market without these platforms. Shopee and TikTok Shop are two of the largest platforms; however Tokopedia, Tiki, Bukalapak, and Lazada are also big players in the space.

- Shopee: This platform remains at the top of the list. It holds the largest market share out of any other platforms at 48%.

- TikTok Shop: While originally known for its short-form videos, TikTok has made itself into an e-commerce powerhouse through its TikTok Shop feature. It recently became the second-largest platform in Southeast Asia. In 2023, TikTok Shop’s GMV reached $15 billion– increased from $4.4 billion in 2022.

Conclusion

While these statistics are hardly everything there is to know about the e-commerce market in Southeast Asia, these can help paint a picture of the industry. As 2024 comes to a close, keep an eye on Cube Asia’s market data & insights feed for the latest statistics.