Before the era of daily flash sales and gamified shopping, there was 2015. That was the year Shopee entered the market and set off a shift that reshaped Southeast Asia’s (SEA) digital economy. This moment was bigger than Shopee – it signaled the beginning of a sustained acceleration in SEA’s e-commerce landscape. Over the past decade, the region has transitioned from early experimentation to one of the fastest-growing online retail ecosystems globally.

Today, Southeast Asia is on track to become one of the strongest engines of global e-commerce expansion, with Gross Merchandise Value (GMV) expected to reach approximately $350 billion (bn) by 2030 and $630 bn by 2035.

As we highlighted in our previous Pulse Report, SEA’s e-commerce landscape has undergone different stages from 2015 to 2025. As we reach the ten-year milestone, this Pulse Report examines the trajectory that emerges across public estimates, what the next decade is likely to look like, and drivers of this growth curve.

Where does SEA e-commerce stand today?

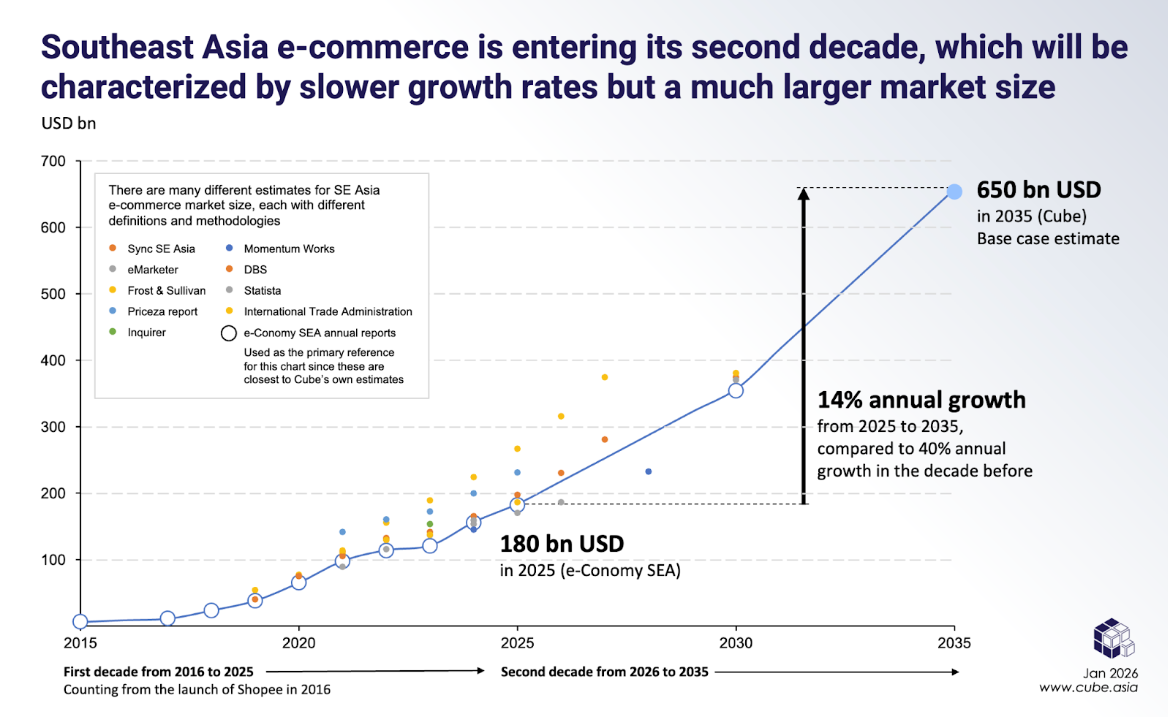

Figure 1 maps publicly available data sources that estimate Southeast Asia’s GMV from 2015 to 2030. While absolute market size estimates vary across sources, the underlying growth pattern is quite consistent, including Cube’s estimates. The data shows an economy that moved from an early take-off phase into a period of rapid, compounding growth, and has entered a more mature stage from 2025 onward. In this phase, growth rates moderate as the base expands, yet remain sufficiently strong for absolute GMV additions to continue increasing significantly.

Looking more closely at these trajectories, the point estimates do diverge. The implied CAGRs for 2020 – 2025 range from ~17% to 23%, a wider spread than the growth range anticipated for 2025 – 2030.

Why is there a dispersion across current GMV estimates?

The divergence reflects less uncertainty in SEA’s growth and more the underlying assumptions across sources.

- Country, Channel, Category splits – Each source allocates contributions differently across countries, channels, and categories. For instance, Cube estimates that the largest GMV contributors in terms of categories in H1 2025 were Fashion & Apparel (26%), Beauty & Personal Care (22%), and Electronics (19%). A forecast that weighs Electronics more heavily, or assumes a larger share from platform-led e-commerce, naturally produces a higher GMV outlook.

- Definition of Gross Merchandise Value – The most commonly used metric in the e-commerce industry is defined in different ways across sources. Some sources include B2B transactions, while others do not. Quick commerce is included in certain datasets and excluded in others. These methodological differences shift the headline figures.

- SEA e-commerce continues to be a rapidly evolving landscape – Even with more mature platforms, SEA e-commerce continues to be very dynamic. Platforms are increasing take rates faster than ever, video and live commerce are penetrating traditionally offline categories, and new shopping formats continue to emerge. Because these shifts occur in real time, point-in-time estimates diverge.

What is driving SEA’s next phase of growth?

From 2024 onward, we see the emergence of a predictable mid-teens growth corridor, a pattern also highlighted in Cube’s joint report with DBS on the post-profitability e-commerce outlook in SEA, and echoed in the latest SEA e-Conomy report.

Several structural forces are shaping this phase of e-commerce growth –

- Increased wallet share – Even though new user acquisition has been plateauing in many markets, existing buyers are spending more online as platforms improve assortment, reliability, and overall value.

- Rise of video commerce and live selling – TikTok Shop has proven that entertainment and shopping can exist on the same continuum, and this shift has created new demand rather than simply reallocating old GMV.

- The region is moving away from a pure price fight and toward identity-driven retail – Southeast Asia continues to be price sensitive, but it is no longer a pure price play, and there is increasing importance that consumers are giving to quality, brand expression, and creator influence. This trend is particularly visible in fashion, beauty and personal care.

- Logistics have become more efficient and reliable – Same-day and next-day delivery are becoming reasonable expectations in major cities. Better first-mile and last-mile networks reduce friction, lower return rates, and increase the confidence to buy more categories online.

- Intense platform competition in which consumers win – The profits generated in high-performing quarters are reinvested, as recently seen in the Q3 earnings reported by Shopee (under SEA Limited), to defend market share, improve loyalty,and expand their ambit of influence.

How big can we expect SEA e-commerce to be by 2035?

When we look at the forecast for 2030, despite different methodologies and coverage definitions, all estimates land between $350 – $380 bn by 2030. Cube estimates the market in 2030 to be at $369 bn. For 2035, Cube anticipates the overall GMV value to be between $585 – 750 bn, depending on the scenario that plays out.

What could lead to different scenarios panning out? Here is a quick overview:

| Scenario | CAGR (2030-2035) | Est GMV (2035) | Drivers |

| High growth | 12.5% | $747 bn | – Social/video commerce penetration increases rapidly and pulls up the average order value

– Logistics efficiency improves rapidly across Tier 2/3 cities – Consumer spending power rebounds strongly |

| Medium growth (Base Case) | 10% | $653 bn | – Logistics improve, but with regional variation

– User acquisition plateaus, while wallet share increases steadily – Existing users buy more frequently and across more categories; AOV stabilizes. – Platforms balance growth with profitability |

| Low growth | 8% | $585 bn | – Macroeconomic headwinds

– Platform consolidation reduces promotional intensity by a large percentage, trimming down the low-order-value customer base – High-AOV categories (electronics, home) grow more slowly than expected; fashion and beauty plateau |

Figure 2 – Different scenarios for Southeast Asia E-commerce in 2035

A big reason for a continued growth horizon for SEA e-commerce is that current big players are starting new growth curves before their current product reaches the flat maturity line. Shopee’s logistics expansion, TikTok Shop’s discovery engine, and Tokopedia’s post-merger ecosystem are each driving fresh cycles of growth. This is reflected in the overall growth story of the region.

The region’s digital commerce market will not return to the extraordinary growth rate that we witnessed from 2020 to 2021. Still, it will maintain a strong compounding path, despite the higher base supported by structural drivers, which we term the ‘Goldilocks zone’. The platforms that succeed will be those that focus on clarity of purpose rather than breadth for its own sake.

The current competitive fight to defend market share will settle into clearer positioning and more sustainable cost structures. Despite the global uncertainty, there is confidence in Southeast Asia’s long-term digital consumption story. E-commerce stopped being an experimental channel in the region long ago. But it is now that it evolves into a mature, essential part of the retail economy, and its next phase of growth will be driven by quality, reliability, and platform specialization rather than sheer volume alone.