While TikTok’s US ban has been stealing headlines, the platform’s global moves have been quietly making waves. In December 2024, TikTok made a strategic move by launching TikTok Shop in Ireland and Spain, marking its first expansion after a one-year hiatus since launching in the US. These launches are particularly interesting to observe as their adoption trends could offer valuable insights into TikTok Shop’s broader potential in Europe.

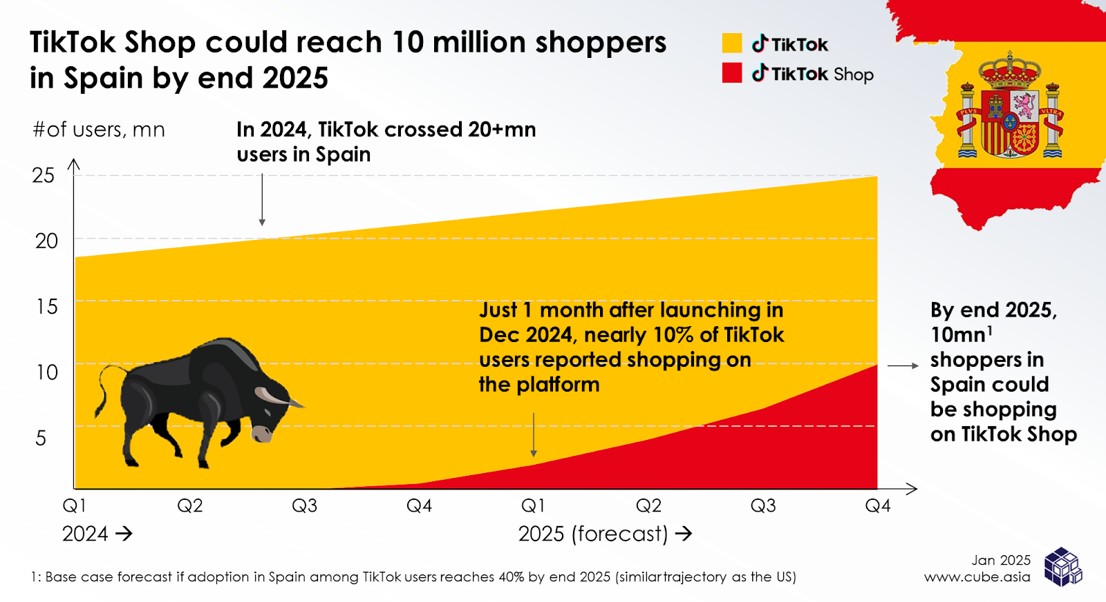

TikTok’s existing user base in Spain provides a strong foundation for the success of its shopping platform. As of November 2024, TikTok had approximately 20 million active users in Spain, representing around 40% of the population. Over half of these are long-time users who have been on the platform for more than two years.

As TikTok Shop enters the Spanish market, several key questions arise: Does high TikTok usage compare to high TikTok Shop adoption? How quickly are Spanish shoppers embracing TikTok Shop? What influences its adoption, and what potential barriers could hinder its trajectory? This article explores these questions, drawing insights from our recent survey of online beauty shoppers conducted before and after TikTok Shop’s launch in Spain.

The survey data indicates that more than 10% of beauty online shoppers have made purchases on TikTok Shop since its launch in December 2024, a promising early traction for TikTok Shop. Early adopters have expressed a largely positive sentiment toward the platform, with many making repeat purchases.

When asked about their thoughts on TikTok Shop in Spain, shoppers shared (translated from Spanish):

“I think TikTok Shop will perform well in Spain because there are many TikTok users here who are willing to shop through the platform. In fact, many already do, and the number keeps growing, so I believe its performance will be quite positive.”

“It’s actually good. I was browsing products while watching videos and thought it was okay, so I bought it.”

“Excellent platform; many of my friends are already using it. I was immediately hooked; it’s so impressive.”

One factor contributing to TikTok Shop’s positive reception in Spain could be the country’s openness to overseas challenger e-commerce platforms. A past survey in November found that 46% of beauty online shoppers had shopped on AliExpress, 41% on Shein, and 39% on Temu. In contrast, TikTok Shop has taken a long time to gain traction in the UK where the e-commerce market remains heavily dominated by Amazon. Shein and Temu adoption rates are lower compared to Spain at 33% and 30%, respectively. This cultural acceptance of new e-commerce models may indicate why TikTok Shop has potential to gain faster traction in Spain. The adoption of overseas challenger e-commerce platforms may serve as a useful benchmark for how widely TikTok Shop could be embraced as it matures, potentially even surpassing their success.

Another factor could be Spanish users’ openness to adopting different purchasing formats, particularly live shopping, which has played a pivotal role in driving TikTok Shop’s growth in Southeast Asia. According to our survey, 64% of respondents have made purchases during a live session and 62% from a short-form video.

In comparison, only 54% of UK respondents have purchased via live shopping, with the majority of sales coming from short-form videos (76%) and the Shop tab (67%). It would appear that Spain’s shopping behavior is more aligned with TikTok’s strength in live commerce compared to its European counterpart.

Despite these positive trends, challenges remain. Some users have raised concerns about TikTok Shop, particularly regarding trust and logistics. Feedback highlighted uncertainty about product authenticity and quality inconsistencies. Logistics inefficiencies were also noted, with one shopper commenting,

“There is a disconnect between local logistics networks, leading to inefficiencies in package handling and transportation. These issues become more pronounced during peak shopping periods, resulting in frequent delivery delays.”

Another user added, “Post-sale logistics systems need improvement.”

The combination of TikTok’s established presence, positive shopper sentiment, and Spain’s openness to new e-commerce platforms signals strong potential for TikTok Shop’s success. While we anticipate continued growth in adoption, this will hinge on addressing challenges around building trust and enhancing local operations. With continued refinement, TikTok Shop is poised to redefine shopping in Spain—one scroll at a time.