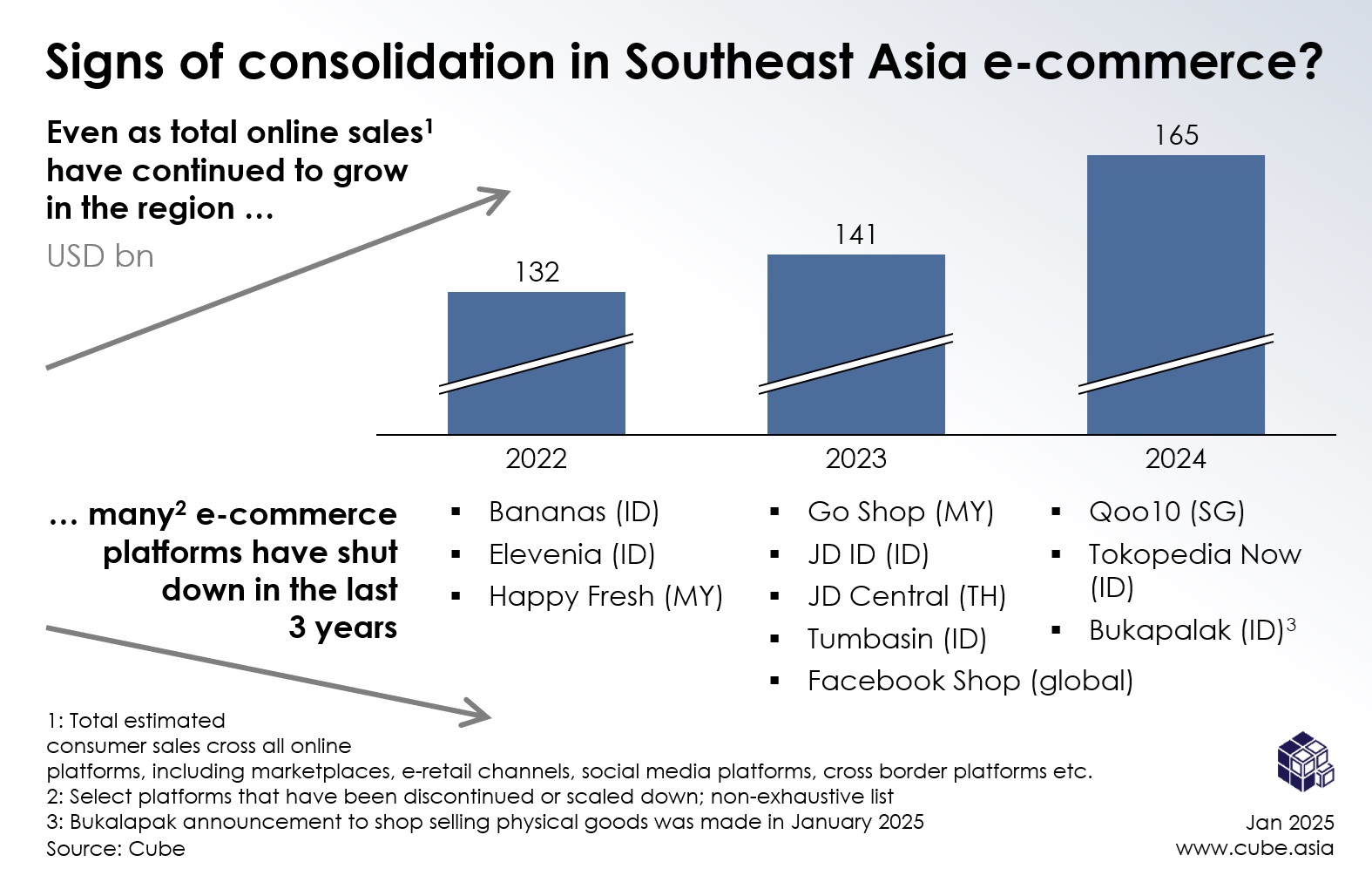

Wow! They grow up so fast.” is often said about children. But the same can also be said about e-commerce in Southeast Asia, which in just 15 years has grown from naught to a sector worth USD 165 billion in 2024.

Now though, the landscape is showing signs of consolidation, with major platforms strengthening their foothold while others seeing their market share decline — some have even exited completely. Despite total online sales growing at a healthy 15+% every year, increasing competitive intensity has made it difficult for mid-sized and smaller players to maintain sufficient scale and sustain growth and profitability.

Over the past three years, numerous platforms across Southeast Asia have scaled down or shut down, reflecting the broader trend of consolidation in the industry amid rising competitive intensity.

Why are these players shutting down?

1. Market share is becoming concentrated among large, well-backed platforms, led by Shopee, TikTok Shop, and Lazada

Leading platforms continue to expand their market share, making it increasingly difficult for smaller competitors to survive. Shopee and Lazada, as first movers in the region, have aggressively scaled their ecosystems to strengthen their competitive position (the former more than the latter). A larger market share has provided them scaling advantages as they benefit from being “top of mind” for active shoppers, securing good deals and prices, attracting a vibrant seller and assortment landscape, and having more efficient infrastructure.

In the last few years, many other large players have tried to challenge their dominance. But with the exception of TikTok Shop, they have all failed.

A case in point is JD’s withdrawal from Thailand and Indonesia last year. Despite being a major player in China, with good funding and a clear quality value proposition, JD struggled to gain traction in these already dominated markets. JD’s strengths lay in its promise of authentic products and fast delivery. But both Shopee and Lazada kept refining and expanding their offerings, including scaling up their “Mall” as a place to go for authentic products. This led to JD eventually exiting the region, citing fast-changing e-commerce and intense competition.

2. Rising costs and operational challenges are straining e-commerce platforms, particularly small and mid-sized players

Rising customer acquisition costs (driven by high competition) and a not-so-steep decline in logistics and warehousing costs (owing to the structurally fragmented geographical landscape in Southeast Asia), have been significant challenges for platforms in the last few years.

In this backdrop, smaller players have faced growing disadvantages in sustaining operations. Beyond needing to compete with heavy marketing spending — including discounts, subsidies, and advertising — these platforms have also struggled to adjust seller commissions to boost revenue. In contrast, larger platforms have benefited from two key scaling advantages. First, they have been able to increase their take-rates, including commission fees and seller packages, while smaller platforms have not, allowing them to strengthen revenue streams while remaining attractive to both sellers and users. Second, their infrastructure in logistics and warehousing (for Shopee and Lazada), and large scale partnerships (TikTok Shop and J&T for example) have enabled them to maximize capital utilization and reduce costs.

An example of a player that has not been able to keep up is Bukalapak. The platform’s physical goods e-commerce business is set to close in February 2025 after the company announced it was reevaluating various business segments after Q3 2024 earnings update where it remains loss-making. The impact of this will not just be on the competitive dynamics of the overall landscape, but also on the company’s employees. This strategy shift will lead to layoffs in the next quarter as the company focuses on its core areas, including Mitra Bukalapak (its online-to-offline arm), gaming, investments, and selected retail services.

3. Adapting to evolving consumer shopping behaviors requires significant investment for platforms

Evolving consumer shopping behavior, driven by live shopping, influencer commerce, and integrated social media sales, is reshaping the online shopping landscape. Platforms that fail to adapt to the changing behavior risk losing relevance as shoppers engage more with content-driven, interactive experiences. Successfully integrating these formats requires significant investment, creating a divide between platforms that can evolve and those struggling to keep pace. Large platforms like Shopee and Lazada have the resources to invest in new features, while smaller platforms lack the scale to replicate them at scale.

The fact that TikTok has been the only successful challenger in the last few years highlights the importance of this point. As a video-driven social media platform, it pioneered e-commerce integration with social media, leveraging its user base of over 300 million active users in Southeast Asia to offer innovative shopping experiences like live shopping and short-form videos.

4. Rising capital costs are accelerating market consolidation as investment appetite declines

The last years’ increases in interest rates have also raised the cost of capital, significantly impacting Southeast Asia’s e-commerce sector. This shift has led to a decline in investment appetite, making it harder for new entrants to secure funding and for established players from other regions to expand in Southeast Asia. In 2023, the number of fundraising deals across tech startups in the region fell by 39% compared to 2022, with the total value of these deals dropping by 42%. And in 2024, startup funding fell for the third consecutive year, dropping to just a fifth of its 2021 peak, as investors braced for growing uncertainties under the new US administration.

Meanwhile, well-capitalized incumbents are better positioned to maintain their dominance, further accelerating industry consolidation.

So what’s next?

For online channels who are not Shopee, TikTok Shop, or Lazada, adaptability and scale will be key to survival.

The ongoing consolidation in Southeast Asia’s e-commerce market is expected to continue, with more mid-sized and smaller platforms potentially merging or exiting. Leading players are likely to reinforce their dominance through strategic investments, technology integration, and expanded ecosystem services.

This doesn’t mean that there is no room for anyone else, but other e-commerce channels will need to work harder to differentiate, target niche market segments, and adopt innovative business models. Those unable to keep pace may become casualties of the consolidation wave.