It has been a challenging couple of years for Lazada, Alibaba’s e-commerce platform in Southeast Asia. After entering – and arguably helping create – the region’s modern online shopping market in 2012 as a first-mover (then backed by Rocket Internet), Lazada’s competitive environment got tougher and tougher over the years. First, Shopee emerged as a formidable regional competitor from 2015/2016. Then, more recently, TikTok Shop and Temu have also joined as new challengers.

This context presents an important question: How should we all think about Lazada’s prospects going forward?

Looking back: Lazada as a key driver of Alibaba’s growth

Lazada’s acquisition by Alibaba didn’t happen in one fell swoop, but over a series of investments that started in 2016. Lazada’s reported revenue at the time was US$190 million in the first nine months of 2015 – extrapolating that to the full year and assuming a 5% take-rate, it would suggest a GMV of about US$4 billion in 2015.

Many years later in 2021, Alibaba announced that Lazada’s GMV had grown to US$21 billion in the 12 months till September 2021. At the time, it was announced that “the company aims to reach US$100 billion in GMV and to raise its customer base to over 300 million. However, it didn’t specify a timeline to hit these targets.” A year later though, Forbes reported a timeline of 2030.

More recently, when Bangkok Post reported earlier this year in June that “Alibaba would like to sell Lazada as the e-marketplace segment faces intense competition from Shopee and fast-rising TikTok”, the company almost immediately came out with a statement that “Lazada Group is not considering any divestment of our business in Thailand and is not in discussion with any investors on this topic. Any rumours stating otherwise are untrue.”

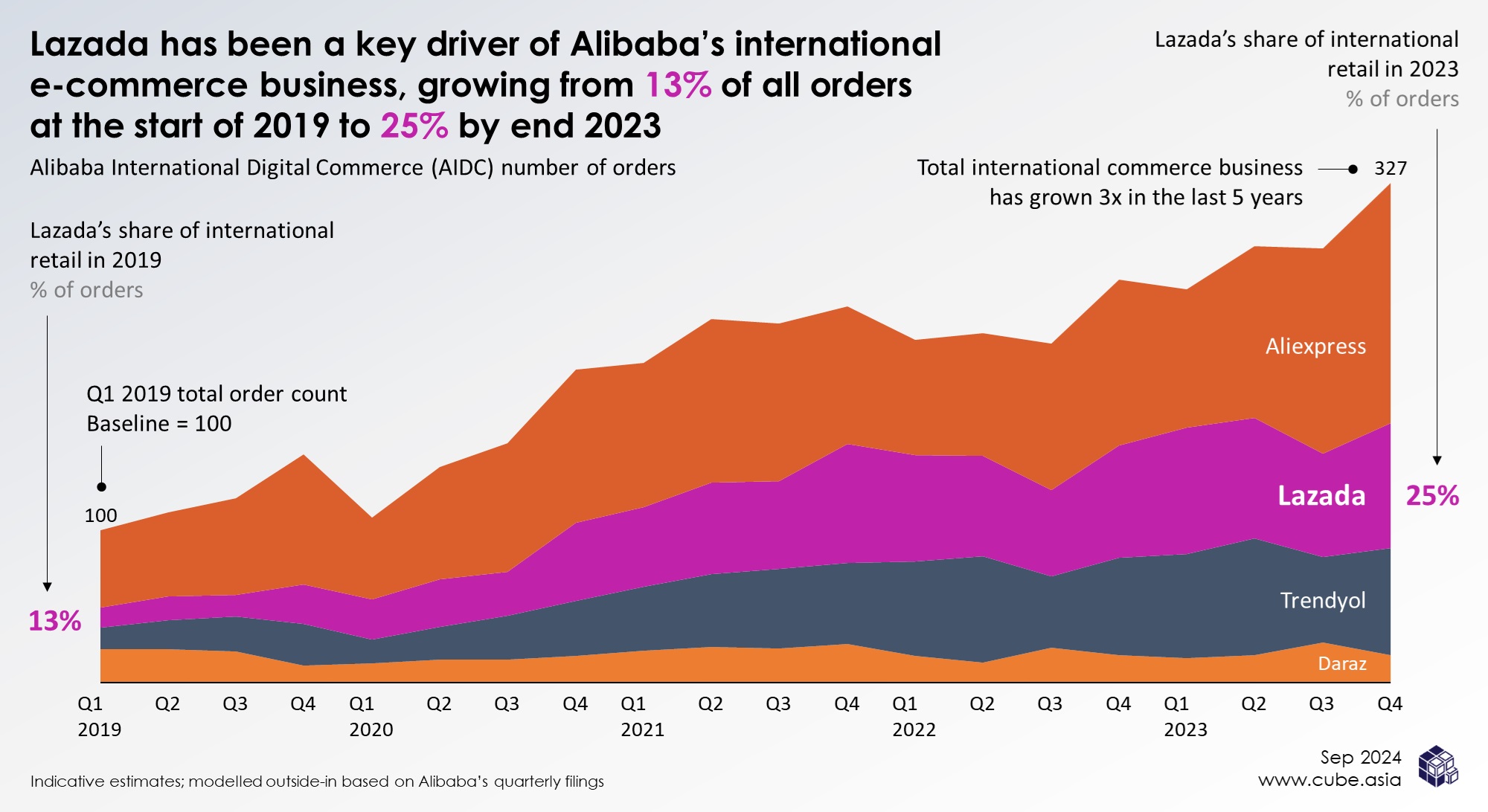

It is understandable why Alibaba has supported and defended Lazada throughout. New Cube analysis (see chart above) indicates that Lazada’s share of orders in Alibaba’s international e-commerce group (“AIDC”) has grown meaningfully over the past years, from 13% in the beginning of 2019 to 25% at the end of 2023. We believe this makes Lazada strategically important to Alibaba.

Looking forward: The ride promises to get bumpier

The US$100 billion target that Alibaba had announced for Lazada in 2022 looks all but impossible at this stage. From multiple sources, Lazada’s GMV has been unable to grow past the 20’s in the last three years, while Shopee has galloped from US$62.5 billion in 2021 to – what is likely to be – in touching distance of US$100 billion in 2024 – with the majority of that coming from Southeast Asia. During the same time, TikTok Shop has come out of nowhere and will end 2024 bigger than Lazada.

In the immediate term, Cube’s market data analysis and our conversations with industry stakeholders including sellers and enablers reveal some causes for concern:

- Our GMV tracker indicates that Lazada’s sales in the first half of 2024 decreased by more than 10%, in a year when Southeast Asia’s e-commerce market is growing in the high teens

- Some sellers and enablers are gradually shifting their focus away from joint business planning with Lazada in favour of focusing more on platforms like Shopee and TikTok Shop (a stance corroborated by sources in a recent Tech In Asia report, which Cube was also quoted in)

It is however not all doom and gloom. There are also some encouraging indicators about the business:

- Lazada was reported to reach positive EBITDA for the first time earlier this year in July, and has benefited from the industry’s rapidly rising take-rates in 2024; everything else being equal, this should make the business more resilient

- Some of Lazada’s recent feature launches have been meaningful, such as the discount shopping model Choice and the on-going roll-out of Alibaba’s powerful product image search technology

So where is Lazada headed?

This mix of indicators makes it challenging to form a clear verdict over Lazada’s near- and mid-term prospects. We do however have a couple of perspectives:

- Lazada’s time as Southeast Asia’s #1 e-commerce platform is unlikely to come back, perhaps ever – Shopee has simply become too large in comparison

- It will be challenging for Lazada to differentiate itself on exclusive sellers and brands; most sellers will want to “hedge their bets” and also list on other e-commerce platforms

- Lazada still has the advantage of a good reputation, including among the region’s most affluent consumers; perhaps Lazada can carve out a position as a “low volume / high margin” e-commerce platform focused on high-quality goods

- We have yet to see Lazada present an exciting plan for the next stage of growth, and we believe this will be crucial to help sellers and other stakeholders understand what to expect going forward

As the last point above alludes to, what we need the most at this point is Lazada’s own voice, to share with the industry what is next in store for it. Articulating an exciting plan, backed by the considerable might of Alibaba, would immediately breathe new life into Lazada.