Lazada who?

Despite being the second-largest multi-category e-commerce platform in Southeast Asia, Lazada arguably doesn’t quite get its fair share of media coverage.

The parent companies of both Shopee and Lazada declared their Q1 2023 results last month. While Shopee’s results got extensive coverage – both good and bad, we have found only one Lazada-focused story published after Alibaba released their quarterly results, and it carried a warning that the platform is “about to become a very lucrative failure.”

Part of the reason for this difference in popular mindshare is likely that Shopee forms a larger share of its parent, Sea Ltd, than Lazada does of its parent, Alibaba Group.

Another difference is that whereas Shopee is known for making big and bold moves – such as moving in or out of markets far away from home, and emerging platforms like TikTok make the news for driving innovation in new areas such as social commerce, Lazada appears more content to just working within the same boundaries it had set for itself a decade ago. When was the last time you heard Lazada make an announcement that made you go “Wow!”?

A glowing beacon in the dark

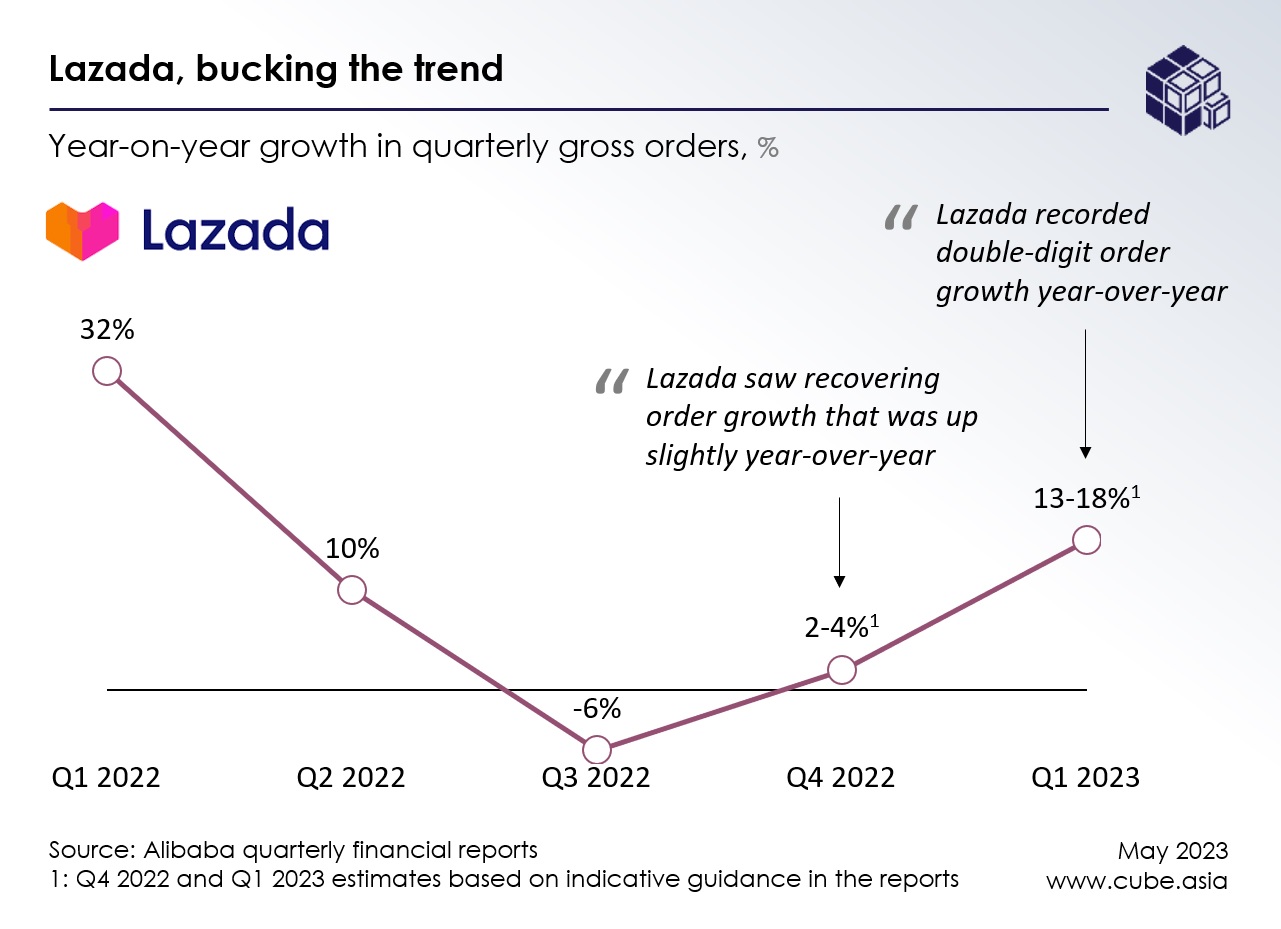

Nonetheless, something special has been happening in the last 6 months. Lazada appears to be bouncing back.

In Alibaba’s financial reporting, Lazada is grouped with AliExpress and other international e-commerce properties like Trendyol and Daraz in the segment ‘international e-commerce’, all of which were collectively reported to have seen double digit year-on-year order growth in Q1 2023.

Among this group, both Ali Express and Lazada matched the overall group average of “double-digit order growth”. For Trendyol, the order growth “remained resilient”. Daraz’ order growth isn’t mentioned in Alibaba’s reporting, although – or probably because of that – one can assume it would not have been much better than Trendyol, given both platforms are experiencing significant economic challenges in their key markets (Pakistan and Turkey respectively).

Even if we assume a modest “double-digit” growth range for Lazada – at Cube, we estimate 13-18% – that is impressive against the recent backdrop of gloomy headlines about e-commerce in Southeast Asia.

How is it then, that at a time when other leading players like Shopee and Tokopedia are struggling to grow their toplines, Lazada is beating them all and showing double-digit growth?

Is this a half-time break in the game …?

For the last 5 years, Lazada has been outspent on marketing and new investments by players like Tokopedia in Indonesia and Shopee across Southeast Asia. But over the past six to nine months, those very players have drastically scaled back their spending to improve their profitability.

For consumers, this means fewer big discounts. And for brands, narrower margins as the leading platforms have tried to push up take-rates by hiking seller fees and introducing more on-platform advertising products. This has created an incentive for both sellers and buyers to look for other channels.

Lazada has been able to position itself as an alternative in that atmosphere. Not being a public company – not yet at least – means it hasn’t had to shift its gears towards profitability quite so suddenly as Sea and GoTo had to when the economic winds turned last year. One could even argue that Lazada’s strategy of steadiness is paying off.

Whether this era of increased scrutiny of platform profitability is the new reality, or just a half-time break before competitive intensity in e-commerce picks up again, is up for debate. Regardless, this will be a defining moment for Lazada – one to rebuild its preferred status with consumers and brands alike.

… or window dressing for the upcoming beauty pageant?

Much has been written about Alibaba’s plans to split its business up into multiple separate entities and to pursue IPOs or capital raises for each of them. One of the 6 new entities will be an international e-commerce group that includes Lazada, Daraz, Trendyol, and AliExpress. The management teams of those companies are undoubtedly preparing for this moment and trying to strike the right balance between growth and profitability to tell the right story to investors.

The chart of this post, juxtapositioned with the almost inverse trends of Shopee and Tokopedia, could make for a compelling story at the investor roadshows. For that to happen though:

- This growth will need to be sustained for a few more quarters to reassure investors that it isn’t just a flash in the pan, which will depend on how patiently especially Shopee continues to sit on the sidelines, and also on how aggressively TikTok Shop continues to drive its e-commerce engine, and

- It will need to be matched by a healthy bottom-line when the kimono does open, for in a competitive environment where both Shopee and Tokopedia have become profitable, the long-term sustainability of a platform that continues to lose money – and no longer has the backing of a well-funded mothership like Alibaba – will be highly suspect

What does this mean for brands selling online?

As the Southeast Asian e-commerce landscape continues to evolve, brands must remain adaptable, leveraging the strengths of Lazada at a time when the platform is growing faster than its peers, while maintaining their relationships with established platforms like Shopee, as well as embracing new players like TikTok Shop. In short, as the age old adage goes, don’t put your eggs in one basket. This is a new moment in Southeast Asian e-commerce where opportunism will be rewarded for those who dare.

Lazada market data from Cube

Lazada is part of our Quarterly Southeast Asia e-commerce GMV data set, which is available with fresh figures for Q1 2023. The data set includes our estimates of Lazada’s GMV by market and by category, as well as derivative metrics like the number of participating shoppers, average basket sizes, and average spending per shopper.

Interested in learning more about this data set and our wider e-commerce market data offering? Please get in touch on simon@cube.asia to hear more.