Source: Alizila

Southeast Asia’s e-commerce market could reach $325 billion by 2028, and small- and medium-sized enterprises (SMEs) have been crucial to this growth. E-commerce provided a space for SME owners that has only grown since the pandemic, and in 2022, SMEs contributed almost 45% of the region’s nominal GDP.

The key players in the region have historically been Shopee, Lazada, and Tokopedia, and newcomers like TikTok Shop continue to shape the landscape.

However, in this article, we will dive into how Alibaba fits into the overall e-commerce market share in Southeast Asia, and how they are changing the game for e-commerce businesses.

What is Alibaba?

Alibaba was founded in 1999 as a B2B seller and has since become one of the world’s largest and well-known e-commerce marketplaces by leveraging the internet’s power to create the e-commerce giant that we know today.

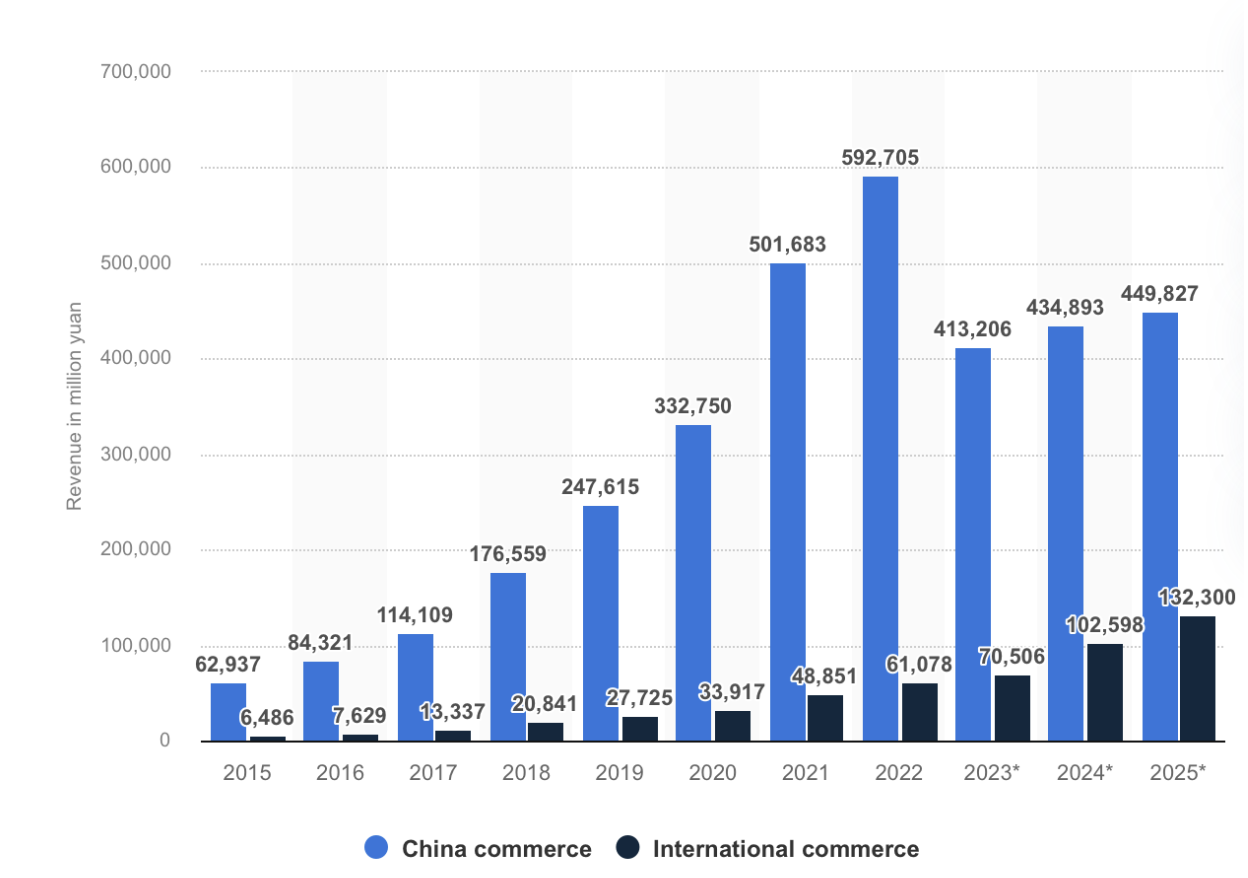

Source: Statista

Source: Statista

Today, Alibaba is not just only a B2B seller, but a platform where B2C and C2C businesses can conduct their sales. The company is behind Taobao and Tmall (both e-commerce platforms catering to Chinese consumers) and even entertainment content. However, while Alibaba may have once been a pioneer in the space, it has been losing market share to PDD (the holding company of Temu) and Douyin.

Alibaba in Southeast Asia

Alibaba has also a large stake in Lazada, which is one of the leading e-commerce platforms in the region, with a specific focus on Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam.

The company has been diversifying its product in Southeast Asia and continues to build its business in the world’s fifth largest economy.

In the past few years, Alibaba is expanding its AI infrastructure in Southeast Asia by building data centers in Malaysia, the Philippines, and an AI hub in Singapore. This investment is slated to invest $53 billion in AI, and train 100,000 workers on its platform. This marks Southeast Asia as a planned hub for AI investment—and to keep up with rising demand for the services.

This is a continuation of its investment in the region. In 2016, Alibaba purchased 54% equity interest in Lazada—equivalent to around $1 billion dollars—allowing local and global merchants to conduct their business on the platform. Importantly, this opened up a brand new market for local and global merchants.

SMEs Are Vital to the Southeast Asian E-Commerce Economy

First, let’s discuss what classifies a business as a small- to medium-sized enterprise, also known as an SME.

According to Cube Asia, a SME is used to categorize businesses which have relatively smaller levels of revenue, workforce, and assets compared to larger corporations.

This definition of a SME can vary based on country or region. For example, in Singapore, a business has to have an annual turnover of less than $100 million, have less than 200 employees, and a balance sheet that does not exceed a certain amount to be considered a SME.

Source: Arthur Little

SMEs are vital to the economy, in both SEA and around the globe. In fact, the Organization for Economic Cooperation and Development (OECD) estimated that SMEs made up around 40% of local GDP and 70% of local employment.

How Will Alibaba’s Expansion Affect Small- and Medium-Sized Enterprises in the Region?

Alibaba’s impact on small to medium sized business enterprises can perhaps be most felt in the platforms’ ability to connect buyers and sellers.

For example, in Malaysia, Alibaba has created a platform specifically for sellers in that country to reach a global audience. This platform, called Halal Pavilion, is a dedicated section of Alibaba’s e-commerce site that aims to connect SMEs selling certified halal products to a global market.

Alibaba has also created programs to support the growth of SMEs in Singapore. The company works with the country’s Infocomm Media Development Authority (IMDA) and EnterpriseSG to provide more opportunities for SMEs to export their products globally. One of these opportunities includes a webpage dedicated to Singapore SMEs, showcasing products on Alibaba’s homepage.

What Does Alibaba’s Growth Mean for E-Commerce in Southeast Asia?

With all e-commerce platforms combined, Southeast Asia’s total e-commerce gross merchandise value (GMV) totaled $145.2B, representing 12.8 percent market penetration.

While Alibaba has its sights set on the Southeast Asian region, its biggest market remains China—accounting for almost 90% of e-commerce revenues there.

Lazada claims that by 2030 they aim to serve 300 million customers, and backed by Alibaba’s technology infrastructure, they are on the right path.