E-commerce in Philippines is growing massively, with a 16% increase in transaction value between 2022 and 2023, reaching $20 billion in the year and is projected to grow to $36 billion by 2027. It significantly impacts Philippines digital economy, making up 1.2% of the country’s GDP and providing 9.68 million jobs.

A young, tech-savvy population with widespread smartphone use and improved internet access has made online shopping essential for many Filipinos. As mobile commerce keeps rising and social media influences purchasing decisions, businesses are transforming how they connect with consumers through digital payments and new engagement strategies.

Philippines’s E-commerce Landscape in 2024: Market Overview and Key Factors

The latest Statista study shows that more than 80% of internet users in the Philippines access the web through their mobile devices, making m-commerce a significant influence in the rapid growth. Based on market performance, the market is projected to hit US$14.66bn by the end of 2024.

Among dominant players in the space, Shopee and Lazada stand out. Both are capturing Filipino shoppers with user-friendly apps, frequent promotions, and seamless shopping experiences. Shopee currently holds the lead, generating USD 405 million in April 2024 sales, while Lazada remains a key player with monthly revenue around USD 224 million.

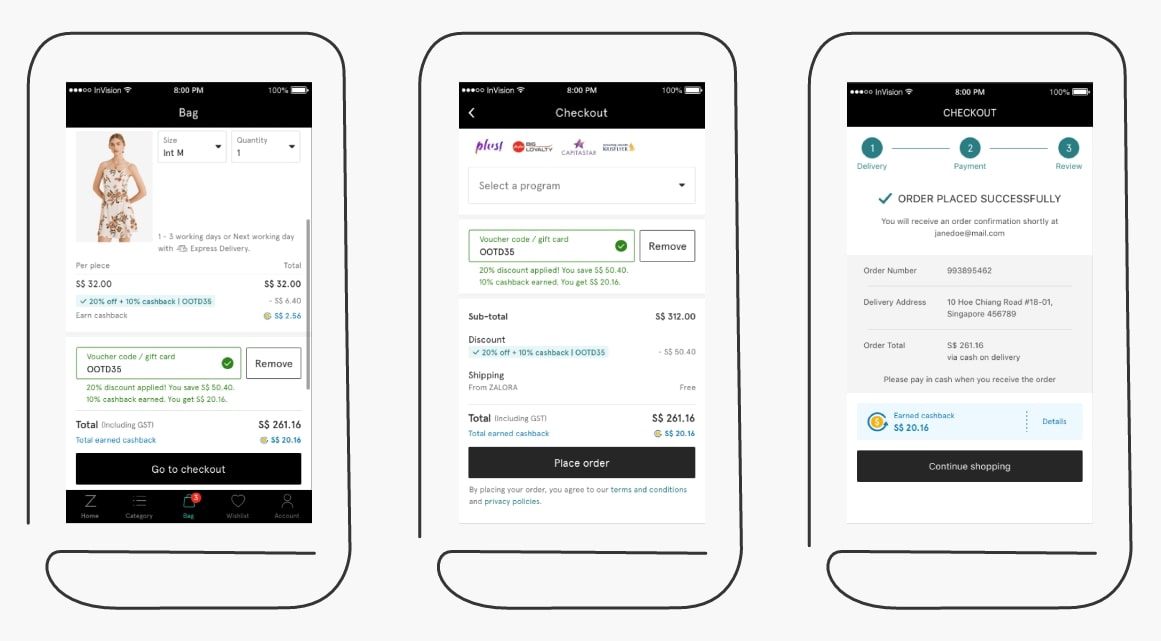

Zalora, a standout in fashion, also attracts a steady base of style-focused consumers. As of the second quarter of 2022, monthly visits to the Zalora website in the Philippines reached approximately 1.77 million. Its focus on exclusive collaborations and stylish collections appeals to more fashion-forward shoppers who prioritize quality and brand name.

In addition to those platforms, specialized options are thriving. MetroMart is gaining traction on grocery and household essentials. Carousell remains a popular choice for secondhand goods and bargains. Together, these platforms contribute to the rich and growing e-commerce landscape in the Philippines, each offering something unique to cater to diverse consumer needs.

Another critical factor influencing e-commerce adoption in the Philippines is the consumers’ payment preferences. Traditionally, Cash-on-delivery (COD) has been favored as a payment method, providing a sense of security that lets shoppers verify products before paying.

Over time, this is gradually changing. You’ll notice an increasing shift towards digital payments, as platforms like GCash and PayMaya gain traction. These digital wallets make transactions more convenient and help build trust in online shopping by offering safe, secure, and efficient payment options.

E-commerce Trends in the Philippines

In the Philippines, online shopping is all about convenience with 65% of buyers prioritizing low prices and free shipping. Additionally, fashion is the most popular category, with 73% purchasing clothing and accessories.

Promotions are also important, with 30% of shoppers loving gift card offers over other deals. Shopee is the platform most people think of first, but the e-commerce competition is still heating up.

These factors are not just enhancing the shopping experience but also setting the stage for emerging trends that will continue to shape the future of e-commerce in the country.

Key trends that are shaping e-commerce in the country include:

1. Mobile Commerce (M-Commerce)

Mobile commerce, or m-commerce, has taken over in the Philippines, thanks to widespread smartphone use—over 90% of Filipinos now own one. With mobile shopping becoming the go-to choice, platforms focus on offering smooth navigation, personalized shopping, and secure payments.

Both local and global giants like Shopee and Lazada have nailed it with intuitive apps that feature tailored product suggestions and exclusive deals, making it easy for shoppers to buy on the move.

One thing that makes mobile commerce even better than traditional website shopping is push notifications. Apps like Shopee and Lazada can send you instant updates on flash sales, personalized deals, or even order tracking right to your phone. It keeps shoppers engaged and makes it super easy to jump back into a deal or check on an order.

2. Social Commerce

Social media continues to shape consumer behavior as many of them are now acting beyond marketing channels but also as direct sales platforms. These days, users in the country frequently discover, research, and buy products directly from their feeds.

Platforms such as Facebook Marketplace and Instagram now allow businesses to engage with customers in real-time while making purchasing products directly within the apps easily. Filipinos often base their buying decisions on what they see shared by influencers, brands, and even friends.

As a business, you can use social media as a direct sales channel to build stronger customer relationships and increase brand loyalty.

3. Cross-Border Shopping

Filipinos increasingly turn to cross-border shopping, seeking products from international stores for better prices, variety, and quality. Platforms like AliExpress and Amazon have gained popularity in the Philippines because they offer products that are not easily found in local markets.

Improved payment gateways and logistics networks make it easier for Filipino consumers to complete cross-border transactions. By tapping into this growing interest in international products, businesses can attract Filipino shoppers who seek unique items or better deals from abroad.

Key Drivers of E-commerce Growth in The Philippines

Several key drivers fuel the rapid growth of e-commerce in the Philippines. They include:

1. Government Support

The Philippine government implemented some strategic policies and initiatives. For instance, the Digital Payment Transformation Roadmap encourages digital payment adoption and makes transactions more seamless. The Internet Transaction Act of 2023 and the eCommerce Roadmap 2022 have also demonstrated the government’s regard for the country’s e-commerce.

The government’s focus on upgrading digital infrastructure and logistics services ensures e-commerce platforms can operate more efficiently, especially in remote areas.

2. Increasing Digital Payment Adoption

For a long time, cash-on-delivery (COD) has been the go-to payment option for Filipinos, mostly because of concerns about online fraud and unfamiliarity with digital methods. But that’s starting to shift as more people are getting comfortable with mobile wallets and online banking.

Services like GCash and PayMaya have completely changed the game, offering a safe and easy way to pay online, which has really boosted confidence in e-commerce. More Filipinos are now embracing these digital options for their transactions.

3. Rising Middle-Class & Internet Penetration

The growing middle class in the Philippines is a major factor driving e-commerce growth. At the same time, internet access is on the rise, with over 76% of the population connected in 2024. With more disposable income, middle-class Filipinos are spending more online and have better access to digital technologies, making them more likely to shop online.

How Your Business Can Stay Ahead of The Competition

To stay ahead, you need to align your strategies with consumers’ evolving behavior. Here’s how:

1. Addressing Mobile Commerce Domination

With 93% of Filipino consumers shopping via smartphones, you want to prioritize a mobile-first approach. Optimize your websites and apps for mobile use to ensure fast load times, intuitive navigation, and seamless checkout processes. Companies that can offer user-friendly mobile shopping experiences will be better positioned to engage with consumers who expect convenience at every touchpoint.

2. Meeting Demands for Low Prices and Free Shipping

Affordability remains a key driver, with 65% of consumers prioritizing low prices and free shipping. To stay competitive, focus on offering promotions and discounts while maintaining profitability. You can achieve this through efficient supply chains and collaborations with third-party logistics providers.

3. Adapting to Cash-on-Delivery Preferences

Despite the rise of digital payments, 62% of Filipinos still prefer cash-on-delivery (COD). Offer both options to capture this audience while encouraging digital payment adoption. Ensuring flexibility in payment methods opens your brand to a broader demographic while gradually introducing incentives for consumers to switch to mobile wallets and online banking.

4. Leveraging Personalization and Promotions

Philippines shoppers appreciate personalized experiences, with 30% of consumers preferring gift card offers. Harness this preference by using data analytics to offer personalized promotions and recommendations.

AI and machine learning can help tailor the shopping experience, improving customer engagement and loyalty. Focus on what resonates with the market to build stronger relationships with your target consumer.

5. Offering a Seamless Omni-channel Experience

Given the increasing digital adoption, integrating online and offline channels is crucial. Consumers now expect a seamless experience, whether in-store or online. Businesses that develop omni-channel strategies, allowing for in-store pickups or returns for online purchases, will better cater to modern consumers’ expectations for flexibility and convenience.

Conclusion

As we have seen, the Philippines e-commerce market is on a solid growth trajectory. Experts anticipate the market to grow more than double in value as internet penetration deepens, digital payments become more mainstream, and the rising middle class continues to fuel demand for online shopping.

Global partnerships and foreign investments will further enhance the sector, creating more opportunities for innovation and competitiveness. Meanwhile, local platforms and brands are adapting quickly, leveraging mobile-first experiences and promotions to attract consumers.

With these trends, the Philippines is set to become one of Southeast Asia’s most dynamic e-commerce markets in the upcoming years.