You might be curious about the current state of digital commerce in Southeast Asia given the advancements in technology.

Digital commerce is consider the 2.0 version of SEA e-commerce.

In contrast to e-commerce, which involves a customer visiting a website or a platform store to make a purchase, digital commerce covers the entire process from when the customer first encounters a social ad or discovers your brand on Google search, through visiting the website store, engaging, making the purchase, and even post-purchase activities.

Put simply, digital commerce includes all the touchpoints – from marketing to promotions to engagement to purchase and sales to analytics to customer service.

Here’s how the digital commerce industry is in Southeast Asia.

Digital Commerce in Southeast Asia

Internet usage and its penetration largely drive digital commerce. The internet economy of Southeast Asia is poised to explode in the upcoming years. Analysts estimate the SEA internet economy at $218 billion in 2023 and forecast it to reach $295 billion by 2025.

With brands becoming increasingly aware of the touchpoints apart from e-commerce, the other aspects of digital commerce – product discovery, social and search ad spending, social commerce, and digital payments- are gaining more prominence.

In this article, we cover these prominent aspects of digital commerce in the context of Southeast Asia:

- Product discovery

- E-commerce market

- Social commerce

- Digital payments

Let’s discuss each of them.

1. Product Discovery

The digital consumer population is projected to hit 402 million users by 2027. Which amounts to 88% of the total population. With it, online shopping and purchasing is expected to grow as well.

With increasing digital penetration, consumers are using more and more e-commerce marketplaces. However, e-commerce platforms are not the only way the consumers are discovering products.

Image Source: INSG

While the e-commerce marketplace is still the leading channel for product discovery, social media is catching up fast. Social media videos have seen the highest growth in product discovery, growing from a 7% share in 2020 to a 21% share as the platform for consumers discovering products and brands.

2. E-commerce Market

The E-commerce market in Southeast Asia has grown rapidly to reach $110 billion in 2022. The same trend is expected to continue, with the e-commerce market expected to reach a projected market volume of $144 billion by 2026.

According to McKinsey, which uses growth in China as a reference point, the e-commerce market SEA region is forecasted to show a double-digit CAGR of 22% to reach a GMV of $230 billion by 2026.

Shopee is the market leader by a margin with a market share of 44%, while Lazada is the second biggest player with a 7% market share.

Data Source: Statista

While there are other known players like Apple and Samsung which operate mainly on electronics, the rest of the market is still fragmented. Tokopedia, for example, has a dominating presence in Indonesia but little to no presence in other markets. The top two players should be looking for a consolidation in the coming years.

Several factors contribute to Shopee’s domination – its focus on mobile-centric shopping experiences, integrated social features that resonate with local consumers, aggressive pricing strategies (flash sales, discount vouchers, and free shipping), a strong logistics network, funding and backing from its parent company Sea Group, and an excellent end-to-end online shopping experience with their payment solutions and own digital wallets.

3. Social Commerce

Apart from traditional e-commerce, SEA is also expected to see rapid growth in social commerce. Social commerce involves the use of social media apps like Facebook, Instagram, TikTok, etc., to promote and sell products and services.

Social commerce has seen a phenomenal rise in the last decade across the globe. Within Southeast Asia, the social commerce market is forecasted to see a 20%-30% CAGR and reach $85-$125 billion by 2027.

Image Source: Cube Asia

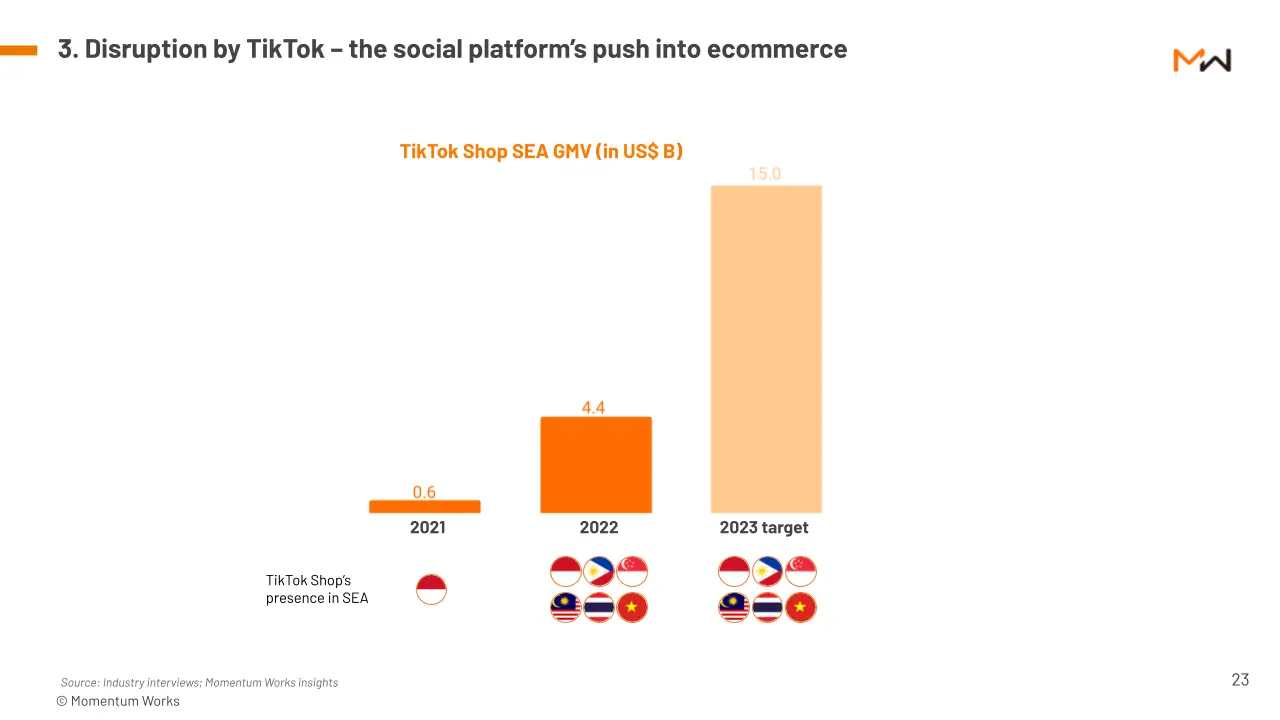

It’s no coincidence most brand recalls and purchases happen after seeing it on social media. Of the social commerce purchases, TikTok is the leading platform in Southeast Asia with an expected gross merchandise value (GMV) of $15 billion in 2023 (up from $4.4 billion in 2022).

Image Source: Momentum Works

However, with TikTok Shop’s recent ban in Indonesia, its growth might slow down and the regulation can potentially initiate other countries to create similar regulations – affecting further growth in the SEA market.

Since more and more consumers are adopting social commerce, brands are increasing their ad spend as well. Wherever the consumer goes, the marketer follows. The ad spend on social media in SEA is projected to reach $4.2 billion by 2028. The forecast predicts that mobile will account for the bulk of ad spend (58%).

With increasing digital penetration and internet usage, social commerce complements and substitutes traditional e-commerce.

Brands are increasing their presence and ad spend on social media channels, and at the same time, the same brands sell their products via e-commerce platforms as well. While traditional e-commerce is still a strong player in SEA, social commerce is slowly gaining a foothold, especially in countries like Vietnam and Thailand.

4. Digital Payments

The total digital payment transaction value in SEA crossed $247 billion in 2023 and is projected to reach $417 billion by 2028.

By 2025, digital payments are forecasted to reach 91% usage of the total e-commerce payments.

Such a rise in digital payments is driving a financial transformation in Southeast Asia. On a global scale, ASEAN countries are at the forefront of mobile wallet adoption rates. Based on World Economic Forum data, half of the top 10 countries in the world in terms of e-wallet penetration are Southeast Asian countries (Thailand, Vietnam, the Philippines, Malaysia, and Indonesia).

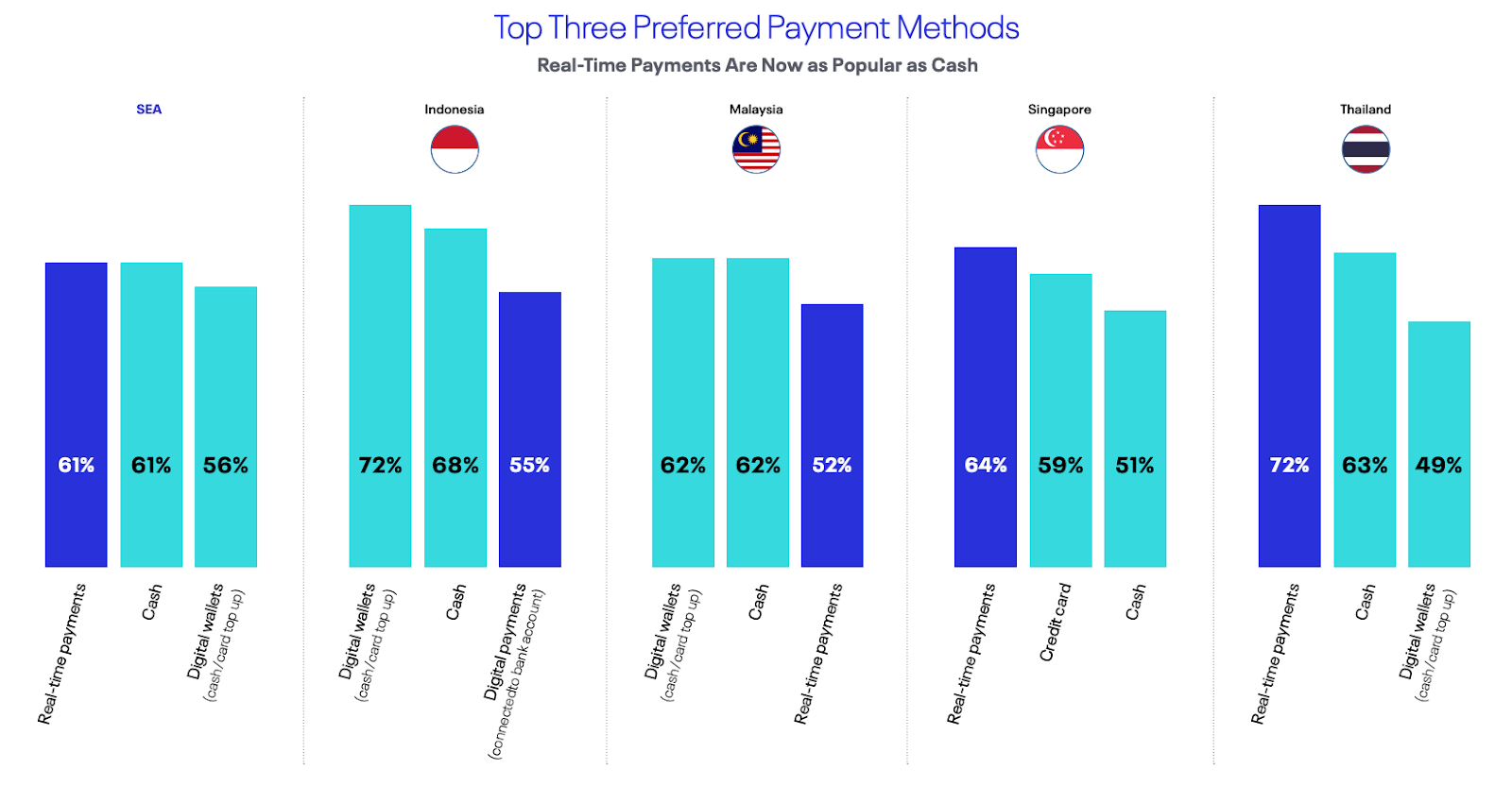

Image Source: Finfan

Real-time digital payments and e-wallets feature as the top payment methods in all of the SEA region. Although Dana and GoPay are the leading e-wallets in Indonesia, Truemoney and Airpay lead in Thailand. Alipay and GooglePay are the market leaders in Singapore. Other players include Ovo, ShopeePay, GrabPay, etc.

Since the e-wallet market appears fragmented on the outside, the same set of companies owns or partners with many of these regional digital wallets. Notably, Alibaba-backed Ant Financial has stakes in Dana, Truemoney, and Alipay.

Challenges and Roadblocks

Nevertheless, digital commerce is booming in Southeast Asia; there are still several roadblocks hindering its growth in:

- Cross-border trade issues: Tariff policies, differing standards, and cross-border shipping complexities impact seamless cross-border trade across the SEA region. Logistics improve domestically, but cross-border challenges require substantial attention from both sectors.

- Payment methods: Digital payment methods are making inroads in leaps and bounds. However, the fragmented nature of the market and friction in transaction processing coupled with pockets of areas with low digital penetration still make switching difficult.

- Localization needs: Southeast Asia is a highly heterogeneous region of 680 million people, comprising more than 1,500 ethnic groups who speak more than 1,000 languages and dialects. This leads to diverse shopping habits, and the digital commerce players have to adopt localization strategies to suit the needs of different groups.

- Regulatory hurdles: Regulatory compliance is another issue adding a layer of operational complexity. High compliance requirements, custom tariffs and clearances, and low transparency pose a challenge for digital commerce growth.

Wrapping Up

Digital commerce is poised to explode in the coming years. Brands have become increasingly aware of the consumer journey—from discovery to visiting the online shop to engagement to making a purchase to post-purchase—and want to track all touchpoints.

It’s no longer just about e-commerce and purchases, especially with social media and social commerce booming. The increase in digital and social ad spending, along with rising digital payments, have boosted SEA’s digital commerce. Despite progress, challenges remain; we need to monitor industry developments in the next decade.