Shopee’s success isn’t by chance. The platform’s growth came from its focus on customer needs, offering easy navigation, secure payment systems, and fast delivery. And as of 2024, Shopee held a commanding 45% market share in Southeast Asia’s e-commerce sector, outpacing competitors like Lazada and Tokopedia.

What really sells on Shopee? What can give your business the best shot at success?

The Beauty & Personal Care (BPC) category on Shopee is booming, and for good reasons. If you’re in ecommerce and aiming to tap into this rapidly growing market, now’s the time to understand what’s driving sales and how you can make the most of it.

Let’s take a closer look at why beauty products are soaring in popularity on Shopee and how you can ride the wave of this exciting trend.

Beauty & Personal Care is Shopee’s Category in Southeast Asia: Here’s Why

Anyone who’s ever gone a day without their go-to moisturizer understands just how indispensable certain beauty products can be. They’re not just a once-off purchase; they’re an everyday staple. That makes them a consistent, reliable source of sales for online retailers. The demand is there, and it’s growing by the minute.

Key segments like skincare, makeup, and haircare are all seeing remarkable growth. Skincare is leading the charge, with products ranging from the basics, like cleansers and sunscreen, to more specialized items like serums and anti-aging creams, which have become increasingly popular in the region. As more consumers look for beauty solutions that deliver results, the demand for these products continues to rise.

Country-Specific Beauty Trends Across Southeast Asia

Beauty sales on Shopee reflect distinct trends across Southeast Asia. Indonesia leads with a $9.24B market and 51% Shopee share, fueled by affordable pricing and local influencer campaigns. Vietnam follows, with $61.55M in monthly skincare sales driven by K-beauty and Shopee Live.

Singapore favors premium, eco-friendly products, with the market set to reach $1.365B by 2033. Thailand’s $9.7B GMV shows strong demand for luxury skincare.

In Malaysia ($3.2B) and the Philippines ($7.5B GMV), affordability and skincare trends dominate. Shopee wins by adapting to each country’s beauty culture and spending habits.

What Are Consumers Actually Buying?

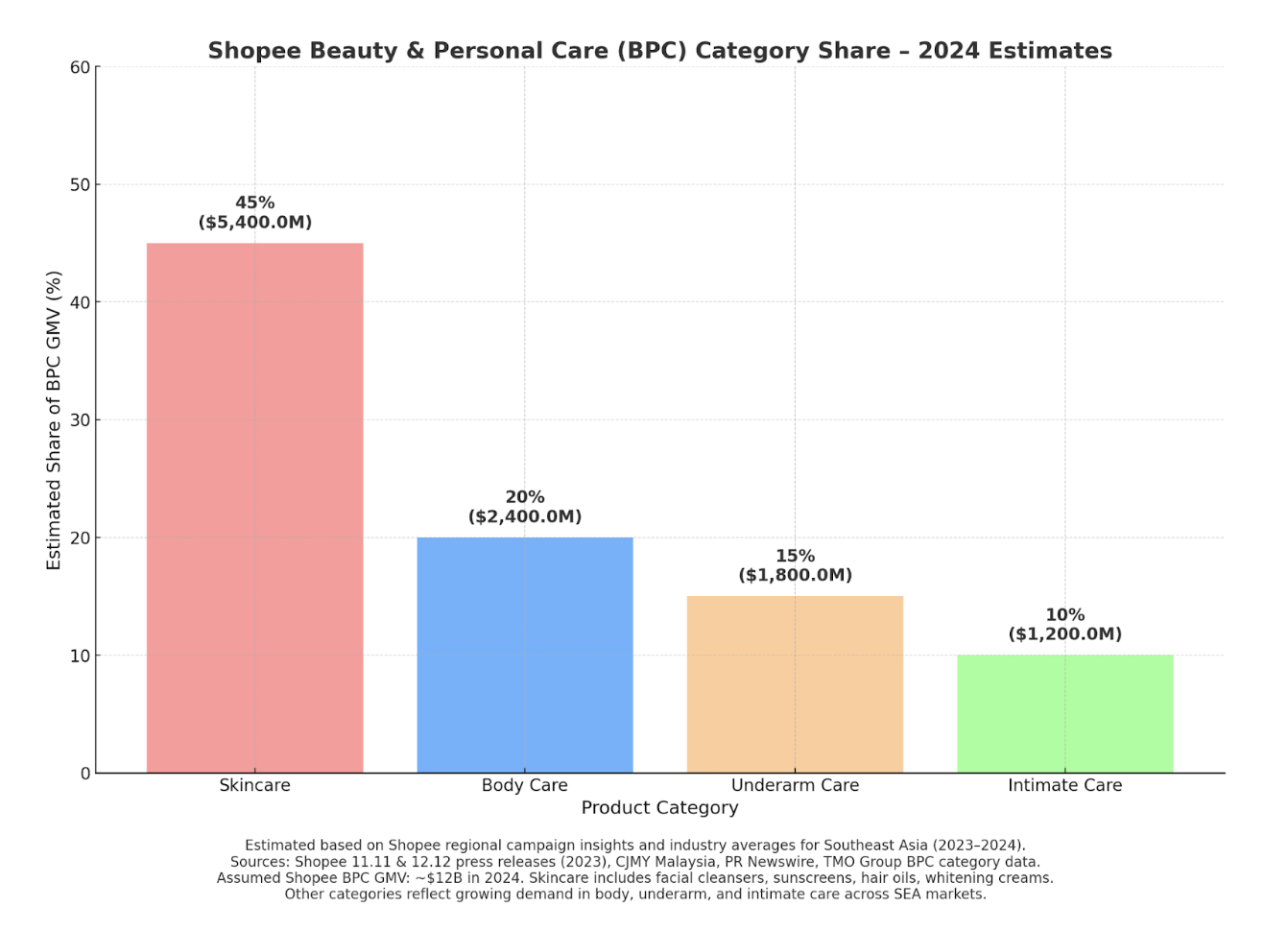

Skincare dominates the BPC market, accounting for a massive 40-50% of Shopee’s Gross Merchandise Value (GMV). When we discuss skincare, we’re referring to everyday essentials like facial cleansers, sunscreens, hair oils, and whitening creams. They’re part of the daily beauty regimen for many shoppers, which means they’re always in demand.

But it’s not just skincare that’s growing. Other categories, such as body care, underarm care, and intimate care, are also gaining momentum. While these segments still represent a smaller portion of the market, the growth potential is there. So, if you’re a brand looking to explore new opportunities, these areas are ripe for the taking.

Affordable Beauty Still Wins, but Premium Products Are on the Rise

Most BPC products on Shopee are priced under $10, and it makes sense, given the mass appeal of affordable beauty items. However, there’s a noticeable uptick in the demand for premium beauty products, especially skincare items like serums and ampoules that cost $25 or more.

Why the shift? Thanks to social media influencers, online reviews, and an overall increase in consumer awareness, shoppers are becoming more discerning. They’re not just looking for the cheapest option anymore, they want quality. People are more informed than ever, and they’re willing to spend a bit more for products that promise long-term benefits and visible results.

Use this opportunity as a brand: you need to strike the right balance between affordable beauty for the mass market and premium options that cater to more discerning consumers. While budget-friendly beauty items will always be popular, premium products are becoming an increasingly significant part of the mix.

The Brands Winning on Shopee

When it comes to top-performing BPC products on Shopee, there’s no one-size-fits-all formula. A good mix of local and global brands is helping drive sales.

Local brands like Scarlett (Indonesia) and Cathy Doll (Thailand) are crushing it by providing high-quality, affordable products that resonate with Southeast Asian consumers. These brands succeed because they truly understand the local market. They know what their customers want and deliver it at a price point that’s accessible for the average shopper.

At the same time, global brands like Garnier, Maybelline, and L’Oréal continue to perform well, especially during Shopee’s major sales events. These big names use Shopee’s powerful marketing tools and affiliate networks to boost their visibility, offering discounts, product bundles, and special promotions to entice shoppers.

Whether you’re a local brand or a global brand, Shopee offers many opportunities to grow. Local brands can leverage their deep understanding of consumer preferences and cultural nuances to build stronger connections with shoppers. On the other hand, global players can take advantage of Shopee’s marketing tools and in-app promotions to boost visibility and reach a wider audience across the region

How Campaigns Drive Beauty Sales on Shopee

One of the biggest drivers of beauty sales on Shopee are the platform’s major sales events. Sales like 3.3, 6.6, and 11.11, as well as payday sales, have become regular highlights for beauty shoppers.

People love Shopee’s big sale days because the discounts are real. Shoppers can get up to 80% off on beauty products by combining brand sales, vouchers, free shipping, and Shopee Coins.

Many buyers plan ahead; they add things to their cart, watch product videos, and wait for midnight to check out. That’s why sales go up fast during these events. In Malaysia alone, over RM38 million in vouchers were used during 11.11. When the deals are this good, people don’t wait. They buy.

These events bring in huge numbers of customers looking to score deals on beauty products, making them essential for any brand hoping to grow its presence on the platform.

Some of the many key performance impacts of these campaigns:

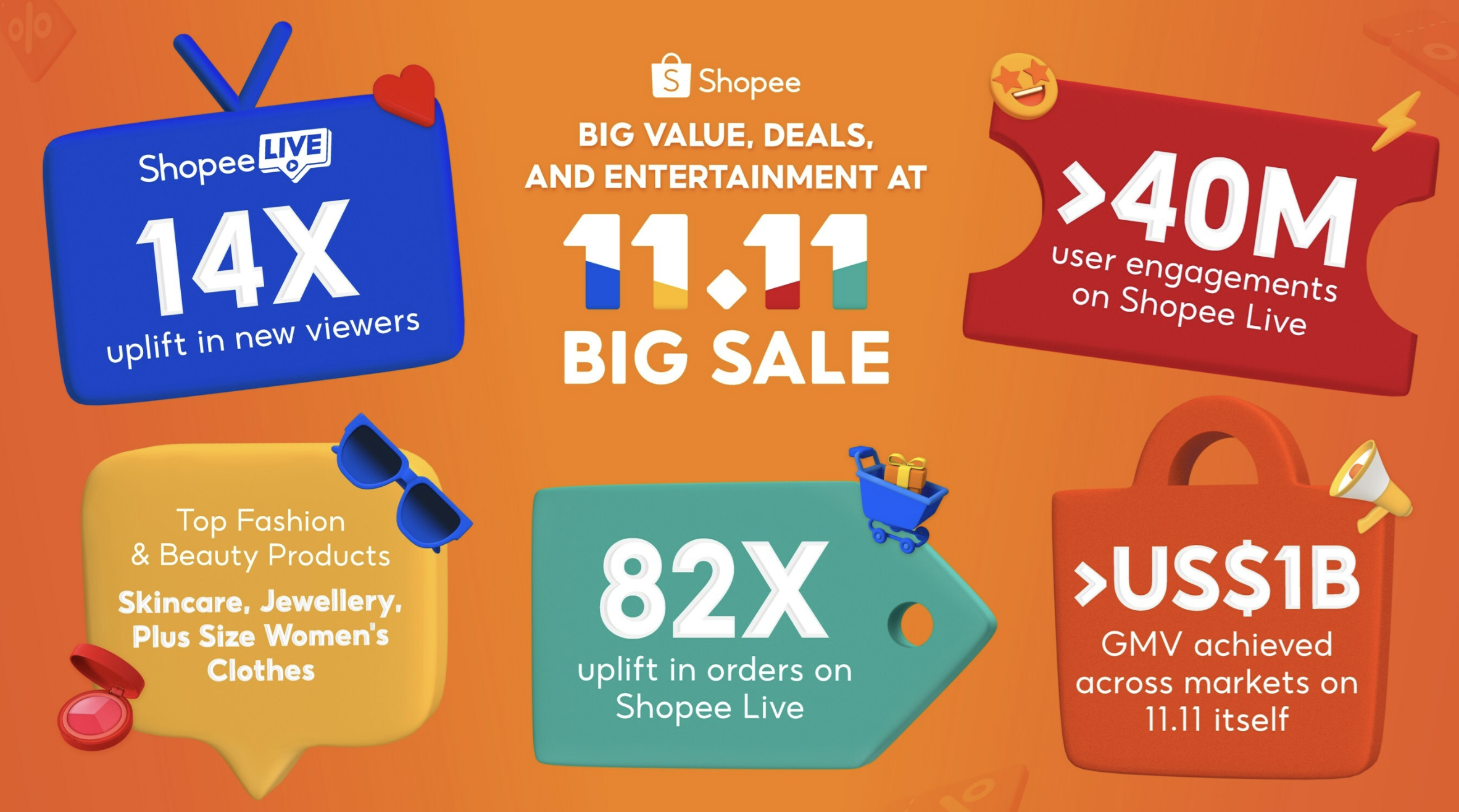

- Shopee Live saw an 82× surge in local seller orders during the 11.11 campaign, driven by live deals, new user traffic, and real-time engagement tools

- Shopee’s official filings reveal that on 11.11 and 12.12 campaigns, the platform processed over 11 million and 12 million daily orders, representing 4.5× and 5× year-over-year increases respectively

- In Malaysia, Shopee Live sellers achieved a 6× uplift in sales on 11.11 compared to normal days, with 38 million vouchers claimed and 29 million Shopee Coins redeemed

To make the most of these campaigns, consider offering product bundles, discount vouchers, and leveraging Shopee’s affiliate program to boost your reach.

If you want to really connect with customers, engage with them through Shopee Live or Shopee Feed, where you can showcase your products in action. By demonstrating how your products work and offering value in real-time, you can convert casual browsers into loyal buyers.

What This Means for Brands

Shopee’s Beauty & Personal Care category continues to show strong growth potential, but thriving in this space takes more than just having great products. To succeed, brands need to truly understand what their customers want, price their products competitively, and take part in major campaigns that boost visibility.

Planning around Shopee’s key sale events — like 11.11 or payday sales — is essential. At the same time, it’s just as important to build awareness across other platforms, such as TikTok. Brands that combine marketplace performance with broader engagement strategies are more likely to see long-term success.

While skincare leads the pack, new opportunities are emerging in categories like body care and underarm care. As shoppers grow more selective, striking the right balance between affordability and quality can help your brand stand out. With the right strategy, there’s plenty of room to grow in Southeast Asia’s booming beauty market.