When Shopee launched and challenged Lazada for dominance in Southeast Asia’s e-commerce platform landscape in 2015-16, low or even fully subsidized selling fees were a key component of its value proposition to sellers. That drove hundreds of thousands of sellers to try out the platform, and in the years to come Shopee and Lazada would gradually inch up their selling fees, attempting to balance a growing need for sustainable unit economics with a worry that high fees would cause sellers to defect to other platforms or channels. As a result, selling fees for both leaders inched up only around 0.5-1% per year until recently.

2024: Game-Changing Fee Hikes

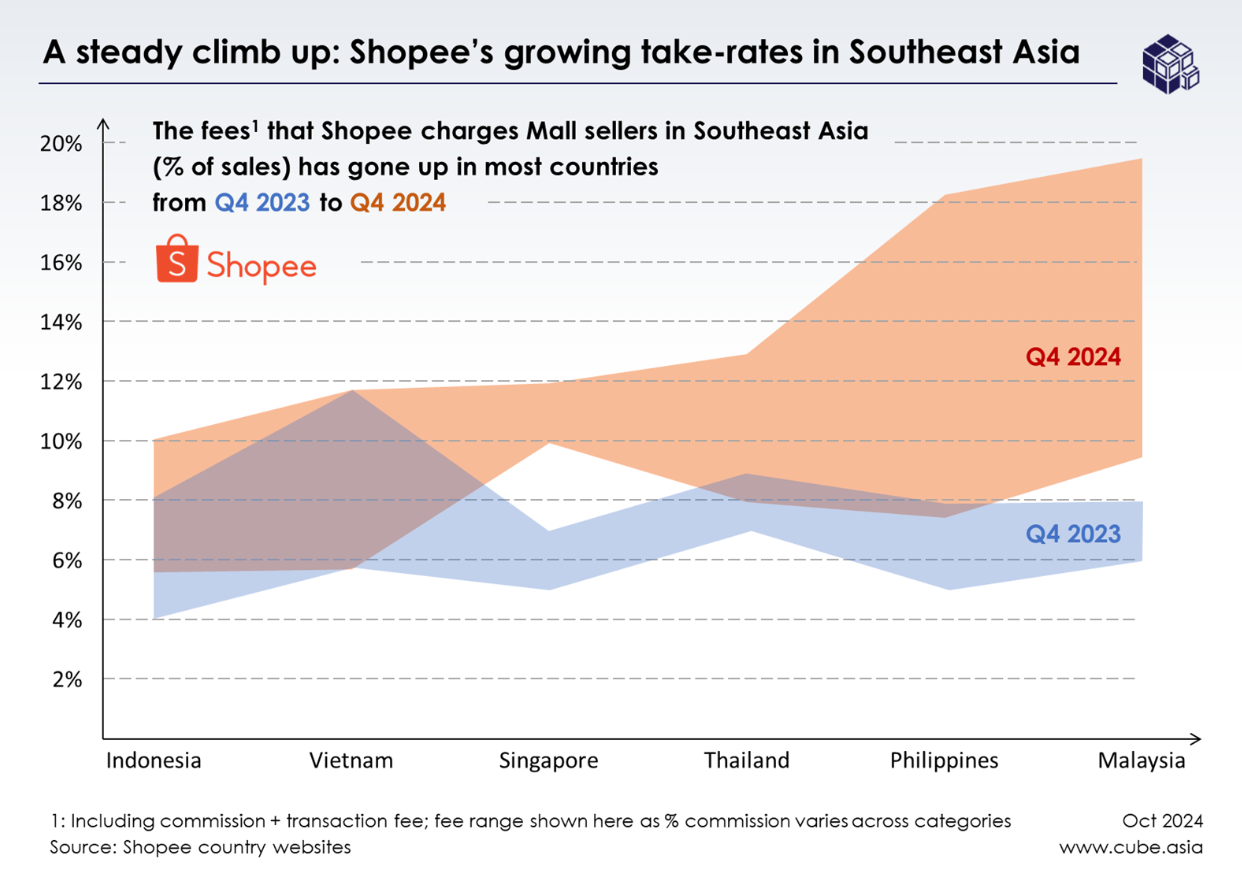

That status quo changed irreversibly in 2024 when Shopee announced substantial fee increases in several countries. As shown in the chart above, within just 12 months, selling fees in many countries increased by up to 10%. Throughout the year, the industry as a whole has held its breath waiting for a reaction – would Shopee, with its dominant market position, be able to force such a big fee increase, or would sellers revolt and move their focus to other selling channels?

In the end, the big revolt did not materialize. Although many sellers expressed frustration with the rising fees, our market data and surveys indicate that most stayed. That has a lot to do with Shopee being the #1 platform in the region, and so the sellers not having the option to leave; and also with Shopee reinvesting most of its rising take-rate revenue in platform subsidies and marketing, which has helped it grow GMV healthily (and ahead of most competing platforms) in 2024. In short, most sellers have felt the fee increases, but most have also seen their sales rise meaningfully in the same period.

Key Outcomes: Shopee’s New Take-Rate Status Quo

As 2024 concludes, we can observe several critical shifts:

- Shopee has increased its selling fees in most markets; through 1-2 fee change waves this year, the effective take-rate of an average Mall seller on Shopee has increased 2~6% versus last year (we keep track through our Shopee Take-rate Tracker)

- There is now more variance in Shopee’s selling fee level by market; we believe this is mainly driven by Shopee seeking to test new highs outside of its largest markets (e.g., Indonesia and Vietnam) and finding it easier to raise rates in markets where it has weaker domestic competition (e.g., Philippines and Malaysia)

- There is now more variance in the selling fee level by category as well, as indicated by the larger orange coloured area in the chart above; Shopee is likely finding it easier to test new selling fee highs in categories with high sales and wide margins

- Shopee also appears to be experimenting with different fee models; for while Vietnam may have the lowest base fee (commission + transaction fee) in Southeast Asia, it has some of the highest service fees for sellers to offer free shipping – participating in the Freeship Xtra program in Vietnam costs sellers 6% per order, down from 8% earlier this year

- The fee increases are not happening in a vacuum; as soon as Shopee’s selling fee increases had settled, other platforms including Lazada, TikTok Shop, and Tokopedia followed to raise their rates too, further ‘settling’ the consolidation we are seeing in e-commerce in the region

- The higher fees have propelled Shopee to positive EBITDA and likely made the e-commerce platform sector profitable as a whole, marking a significant milestone in the recent years’ tough fight for e-commerce platform profitability

Winners and Losers: Platforms, Sellers, and Consumers

How has this new status quo impacted the e-commerce value pool? It has been a great year for e-commerce platforms, and an equally frustrating year for sellers who have had to absorb the rising fees. Consumers have seen some of those rising fee converted to higher prices, but the impact has been shielded considerably by platforms’ higher buyer subsidies.

So, what might happen next? We expect Shopee and other e-commerce platforms to continue testing higher selling fee levels, but to do so at a slower clip than in 2024 to avoid ‘starving’ the seller base too much. There is also less of an imperative for Shopee to maintain the pace of these fee hikes, given that they have already hit profitability. We expect Shopee to seek more of its future take-rate gains in other ways than raising selling fees, such as through its on-platform advertising programs and value-added services from its SPX logistics unit.

At the surface level this may sound like better news for Shopee’s investors than for its sellers, but it is worth bearing in mind that Shopee parent Sea Ltd’s largest stock declines have tended to come after poor GMV growth quarters. Shopee remains highly incentivized to take care of its sellers’ growth and to keep the GMV growth flywheel spinning – it simply can’t afford not to.