An e-commerce marketplace platform is at once a very simple and a very complicated business model.

At its core, success hinges on the platform’s ability to generate GMV (trade volume) and command a sufficient share of that GMV as revenue (also called take rate) to cover its operational costs and be profitable.

Balancing this ‘performance equation’ has however been a steep challenge for Southeast Asia’s e-commerce platforms so far. They have either been able to grow GMV rapidly without being profitable (e.g., Shopee in the past, and TikTok Shop now) or to sacrifice GMV growth for improved profitability (e.g., Lazada, Tokopedia)

One of the key levers a platform can adjust to affect its ‘performance equation’ is how much it invests in sales and marketing through buyer/seller subsidies, advertising, and branding. In a sense it functions like a ‘thermostat’ that platforms can dial up or down to adjust their relative attractiveness to buyers and sellers.

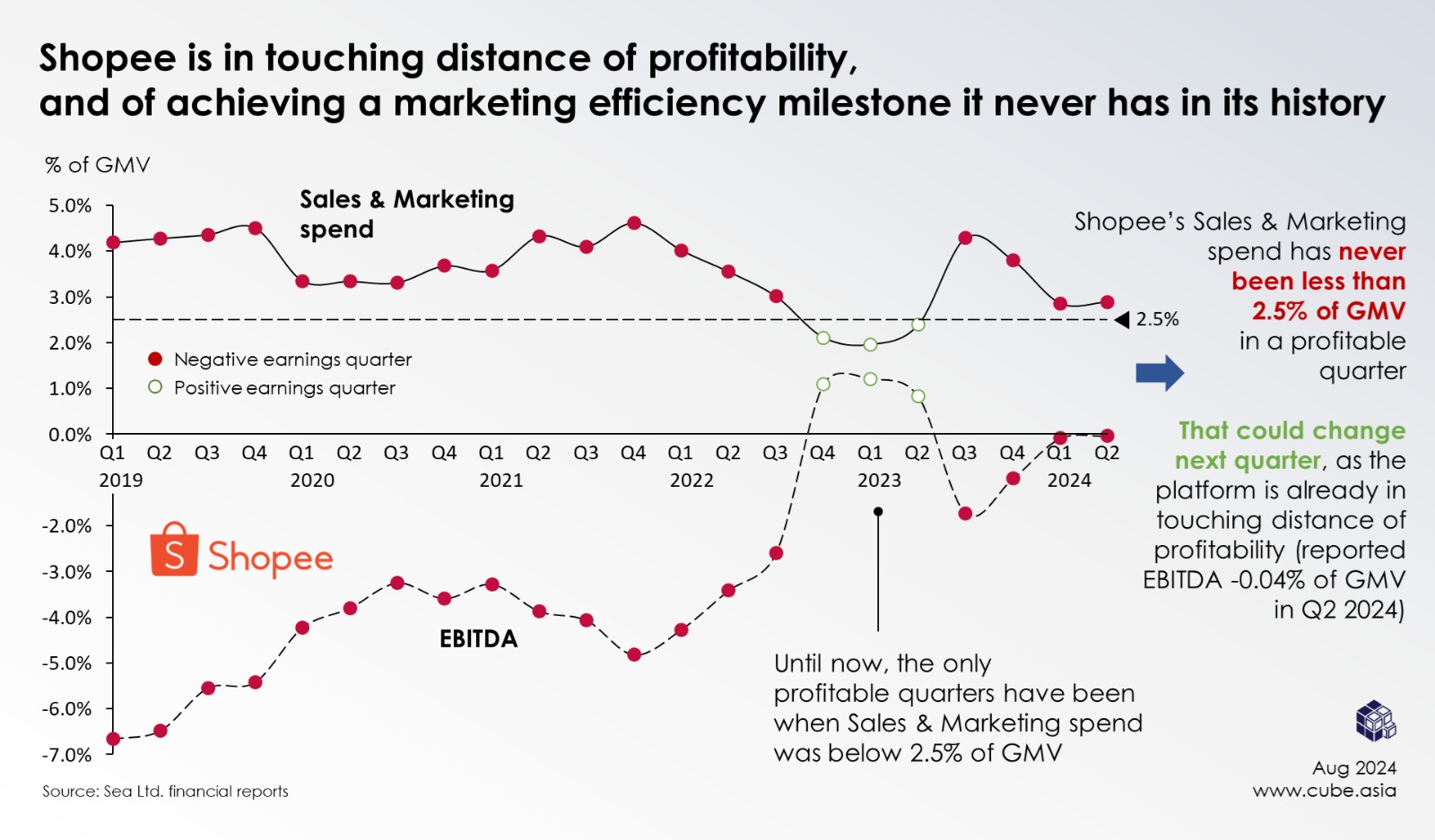

We can see this ‘thermostat adjustment’ play out in Shopee’s journey over the last couple of years (See chart above). To date, Shopee has never managed to break even in a quarter with more than 2.5% sales & marketing spend to GMV.

This does however seem to be changing in 2024 as Shopee and other platforms have managed to meaningfully increase their take rate through seller commission hikes, innovations in on-platform advertising solutions, and other moves.

While big and small sellers alike have expressed frustration and anger with these selling cost increases, our data indicates that few of them are leaving to sell elsewhere so far. That results in increased platform revenue, which becomes available to platforms to flow through to profit, or to re-invest in the business (and in GMV growth) through sales & marketing expense.

And that begs the question: Which path will Shopee and other platforms take in this next stage of growth? Will they re-invest their higher revenue into sales & marketing to keep fueling growth, or will they use it to deepen their profitability?

Our prediction is that once Shopee achieves profitability, a large share of the additional take rate will be re-invested into GMV growth, and that most of it will be through the sales & marketing expense.

This has implications for sellers as well as investors:

- For sellers, it means that while platform costs are rising, some of those rising expenses will also turn into subsidies that will help drive more traffic and sales

- For investors, it means that even though take rates are finally rising and profitability appears within reach, we will likely see platforms optimizing for a very low level of profitability for the foreseeable future

At a high level the message is however resoundingly positive: After years of losses, Southeast Asia e-commerce is finding profitability. And that is great news for all of the sector’s stakeholders.