Historically, the skincare industry in Southeast Asia had been dominated by established brands with longstanding market presence, segmenting the market into either mass or prestige. However, a number of factors have now paved the way for new, challenger brands to disrupt the market. These challenger brands combine affordability with innovation, bringing to the table value propositions such as active, organic, cruelty-free and vegan ingredients in skincare. This study compares two such success stories – The Ordinary and Skintific, one a global challenger brand and the other, the Southeast Asia regional equivalent. Both have made significant inroads in their respective markets by offering unique value propositions.

How do consumers decide which skincare brands to buy?

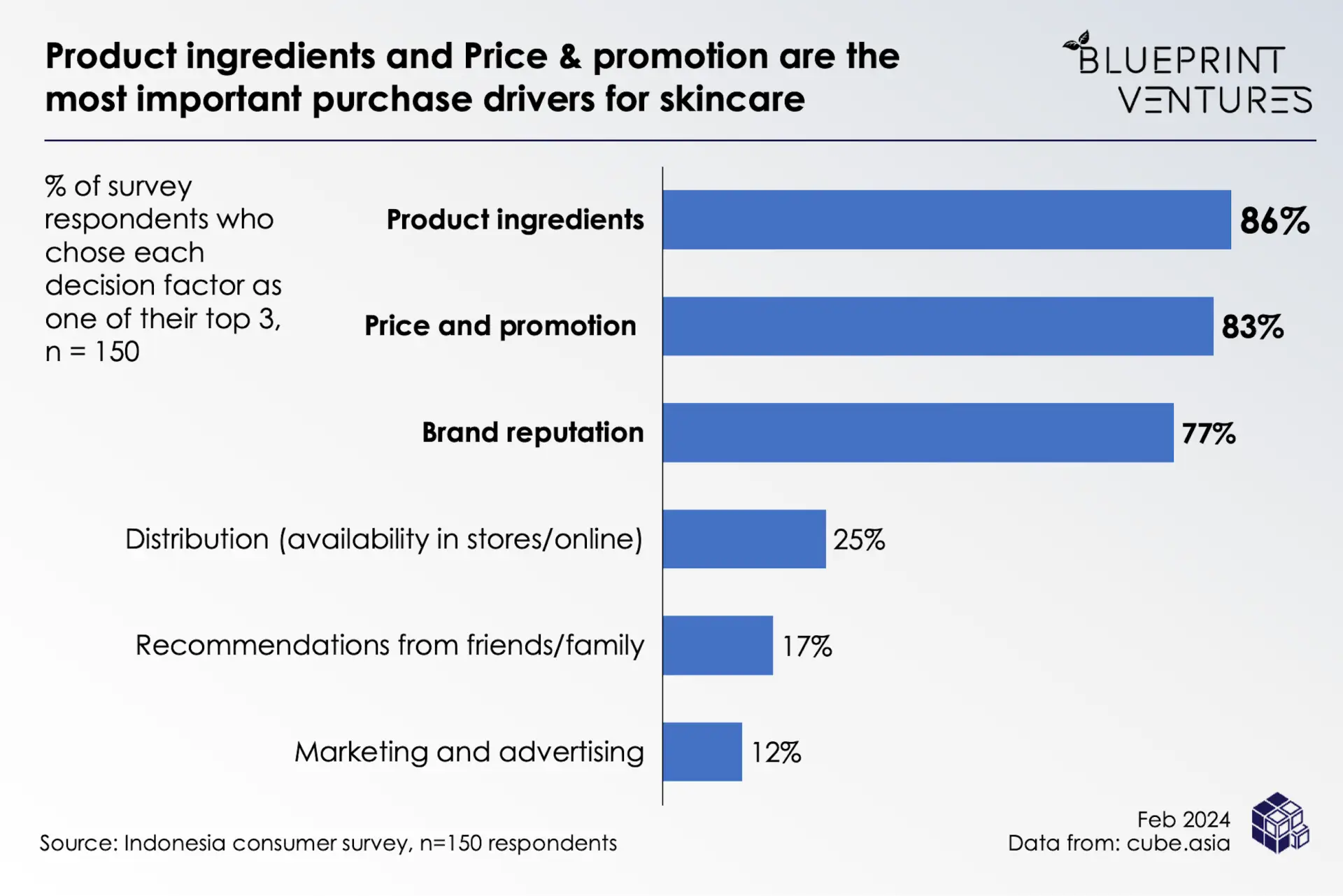

We surveyed consumers in Indonesia to understand which factors influence their skincare purchasing decisions. The findings reveal that ‘Product Ingredients’ (86%) and ‘Price and Promotion’ (83%) rank as the foremost considerations (as shown in the chart above), underscoring the critical importance of offering affordable skincare solutions with effective product ingredients.

Furthermore, 99% of respondents shared that ingredient transparency is either important or very important in their decision when purchasing skincare products, thereby underscoring this strategic approach adopted by these challenger brands. Interestingly, the longevity or historical presence of a brand holds less sway over consumer choices, allowing these emerging brands to outperform even their well-established prestige counterparts, such as Estée Lauder, Clarins, and Shiseido.

The rise of challenger brands

In today’s internet era, social media and e-commerce have unlocked new channels for challenger brands to reach and sell to new customer segments. The Ordinary, hailing from Canada, has taken the global market by storm, achieving viral status through their highly engaged social media strategy. Despite not having an official store on Shopee, TikTok Shop, and Tokopedia, the brands are widely sold by resellers on every e-commerce platform. In a similar vein, Skintific, based in Indonesia, has rapidly ascended to become a top-selling brand in the region, especially on e-commerce platforms. Before Indonesia’s TikTok Shop ban in September 2023, Skintific had more than 10% market share in the beauty and personal care category on the platform. Despite their positions as market challengers, both brands have carved out substantial success. How?

Expanding the overlap between Mass and Prestige = Masstige

The secret to their success may lie in how they have been able to offer products with a premium perception at affordable price points. For example, by actively talking about the active ingredients in their products, they begin to look and behave like a prestige brand. In doing so, The Ordinary and Skintific have shifted the narrative, bringing a high-quality perception to the mass market, effectively expanding the segment now commonly understood as ‘masstige’.

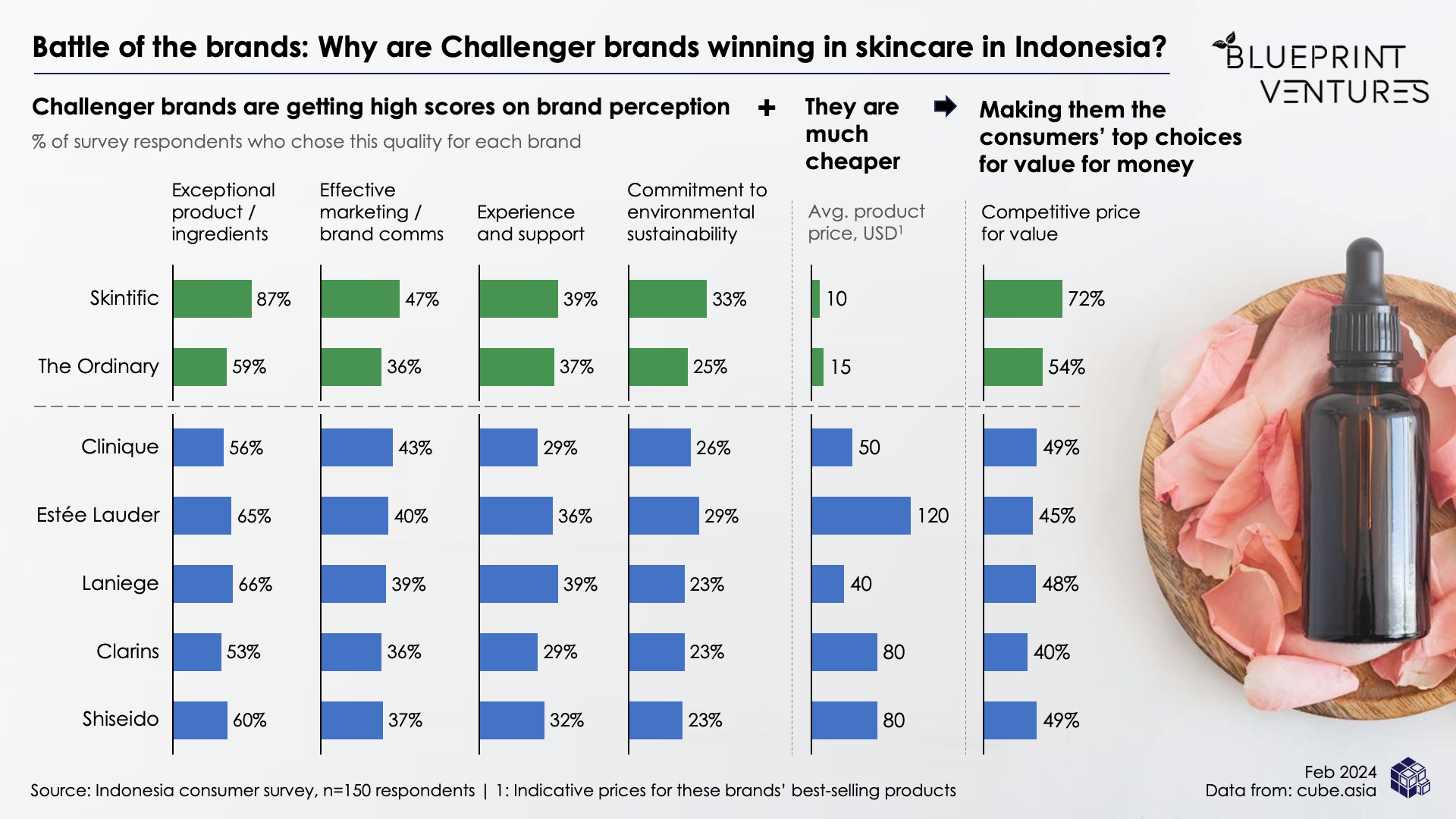

We undertook a comparative analysis that explored 150 consumers’ perceptions on the brands’ strengths against established prestige brands like Estée Lauder, Clarins, Clinique and Shiseido. The results reveal that these challenger brands have managed to foster an equal or (even superior) perception of quality. As a result, consumers are no longer forced to choose between affordability and quality.

The Ordinary: A global challenger that has seen viral success

The Ordinary was founded in 2013 with the aspiration “to communicate with integrity and bring to market effective, more familiar technologies at honorable prices.” The Ordinary is part of DECIEM, a beauty pioneer in science-backed skincare formulations, innovating new products in their in-house laboratory where every ingredient is tested to ensure both safety and effective results.

While originally popular in the West, by leveraging social media, user-generated content, and influencer collaboration, The Ordinary quickly found fame in the Southeast Asian market as well, including Indonesia. As one of the brands that were ahead of their time in TikTok content creation, The Ordinary collaborated with influencers to produce numerous viral short-form videos. These videos garnered millions of views, making The Ordinary one of the skincare brands with the highest number of followers, achieving over 1.5 million followers and 18 million likes.

Originally sold exclusively on their website, the brand has expanded their sales distribution and can now be found in different kinds of retailers, from omni-channel partners like Sephora to specialist online platforms like Lookfantastic. On Shopee and Tokopedia in Indonesia, The Ordinary products are sold by numerous resellers on the platform, indicating a high demand for the brand in the country. The Ordinary is able to cater to the Gen-Z demographic, in particular, with their masstige pricing. The Ordinary is able to cater to the Gen-Z demographic, in particular, with their masstige pricing. They offer an array of skincare and hair & body care products priced starting below US$10. Its best seller, an active ingredients product, the ‘Niacinamide 10% + Zinc 1%’, only costs US$6 for its 30ml size, making the price attainable to its customer group.

The Ordinary also resonates with their consumers through their minimalist packaging and premium ingredient transparency on their bottles. They were one of the first brands to specify the exact concentration of the active ingredients on their bottles. This effort has solidified their reputation as a trusted skincare brand, further endorsed by dermatologists, reinforcing credibility within their consumer base.

Skintific: Indonesia’s homegrown success story

Skintific was founded in 2022 with the aspiration “to create smart products that are accessible to everyone who would like to upgrade their skincare routine with pure active ingredients, smart formulation, and definitely with more advanced technology.” The brand became a sensation in Indonesia through TikTok Shop as one of the early adopters of social commerce, gathering more than 100 million views from its digital marketing strategy. They not only collaborated with various influencers, including Tasya Farasya, one of Indonesia’s top beauty influencers withmore than 15 million followers across her social media channels, but they also engaged affiliates and Key Opinion Leaders (KOLs) to boost consumer purchase intent.

Additionally, live-streaming on Tiktok allowed for real-time product demonstrations, further driving buyer engagement and contributing significantly to the surge of Skintific’s online sales. Their digital marketing strategy has clearly been effective as Skintific scored the highest for ‘effective marketing and brand communication’ in our survey. It is now one of the top selling skincare brands across e-commerce platforms in Indonesia, and is starting to make a name across the region as well. Prior to the Indonesia’s TikTok Shop ban in October 2023, Skintific had grossed more than US$5 million in monthly sales (GMV), becoming the top-seller shop in August and July 2023.

Similar to The Ordinary, Skintific offers effective and innovative products at affordable price points. Leveraging its patented Trilogy Triangle Effect (TTE) technology, Skintific has developed a skincare and makeup line that claims to balance active and barrier-protective ingredients for safe and effective results. They have a vast product range, which includes facial masks, creams, serums, sunscreens, cleansers, and toners. Most of these products are priced between US$3 and US$15. The satisfaction with Skintific’s products is evident as they ranked the highest in ‘competitive price for value’ as the brand’s strength in our survey.

Answering the consumers’ call: Quality at an affordable price point

Across the 7 brands surveyed, Skintific scored the highest in products/ingredients quality, surpassing even its prestige counterparts, like Clinique, Estée Lauder, Laneige, Clarins, and Shiseido. While The Ordinary had a slightly lower scoring, it still managed to surpass Clarins and Clinique, underscoring the perception of their products being on par with prestige brands. Based on an open-ended response, more than 50% of the respondents indicated that Skintific and The Ordinary served well in terms of quality, safety, suitability, and trustworthiness.

And yet, both brands market their products at a fraction of the price of their prestige counterparts, delivering exceptional value to their consumers. The significance of ‘price and promotion’ as a pivotal factor in consumer purchasing decisions underscores the value proposition of these challenger brands. Their average product prices range between US$10 and US$15, distinctly lower than the average prices of prestige brands, which fall between US$40 and US$120. However, it’s crucial to shift the focus from mere affordability to the concept of intrinsic value – reflecting the quality of the product relative to its cost. Consumers are drawn not solely by low prices but by the promise of high-quality products at affordable prices. It’s this value proposition that underpins the success of these challenger brands in capturing market share and fostering its customers.

Challenger brands: Changing the skincare game

Traditionally, premium skincare ingredients were reserved for luxury brands, leaving many consumers without access. However, brands like The Ordinary and Skintific have disrupted this exclusivity. The Ordinary pioneered affordable yet high-quality ingredients, leveraging digital platforms for global outreach. Following suit, Skintific entered the market with a similar approach, quickly gaining local traction and sales. They demonstrated the success of the modern ‘masstige’ market, where premium products are accessible at reasonable prices. Their product quality competes with or exceeds that of traditional prestige brands, all while remaining competitively priced. This shift signifies a new era in skincare for new players in the market, where accessibility and quality merge to redefine beauty standards across the region.

Note: This is an independent report, and has not been sponsored by any of the brands featured in this analysis.

Blueprint Ventures is an early-stage consumer-first venture capital firm. The VC invest across Southeast Asia into consumer and consumer-tech businesses for the new Southeast Asian consumer – Millennials, Gen Zs and Gen Alphas. They make insights-led investments anchored on themes and trends that matter most to them.